That pop, pop, pop you are hearing is craft spirits makers popping open some of their finest spirits as they celebrate the best news these small businesses have heard in a long, long time. Today, President Donald Trump signed the $2.3 Trillion Government spending package which includes making the Craft Beverage and Modernization Tax Reform Act (CBMTRA) permanent. The signing gives the country’s 2,200 craft spirits producers much-needed, permanent tax relief and parity with their counterparts in beer and wine, who have enjoyed lower rates for many years.

After Nearly 10 Years of Work Distillers Earn Parity with Other Alcohol Beverage Makers

“Today we raise a glass to a monumental, near-decade-long effort and to a triumph for our community of craft distilleries,” said Mark Shilling, American Craft Spirits Association – ACSA past President and Chair, Government Affairs, and Founder, Shilling/Crafted. “Finally, this permanent FET reform eliminates what has become a cycle of uncertainty around temporary or even permanent reform. Our industry has a long road ahead as we crawl back from the impact of COVID-19 on our small businesses, but permanent FET reform is one massive roadblock we no longer need to face.”

Introduced by Senators Ron Wyden (D-Ore.) and Roy Blunt (R-Mo.) and by Representatives Ron Kind (D-Wis.) and Mike Kelly (R-Pa.), the Craft Beverage Modernization and Tax Reform Act (CBMTRA) includes reforms enacted in 2017 that create a fair and equitable tax structure for brewers, winemakers, distillers and importers of all beverage alcohol. The tax reduction was renewed for one year in 2019 and was set to expire on Dec. 31, 2020. The bill had broad bipartisan backing with 76 cosponsors in the Senate and 351 in the House.

“We are thankful that President Donald J. Trump and Congress delivered this much-needed economic relief to craft distilleries,” explained Distilled Spirits Council of the United States – DISCUS President & CEO Chris Swonger. “While distilleries have faced extraordinary challenges this year, this legislation making their reduced tax rates permanent will give these distillers a renewed sense of certainty and hopefulness for the future.”

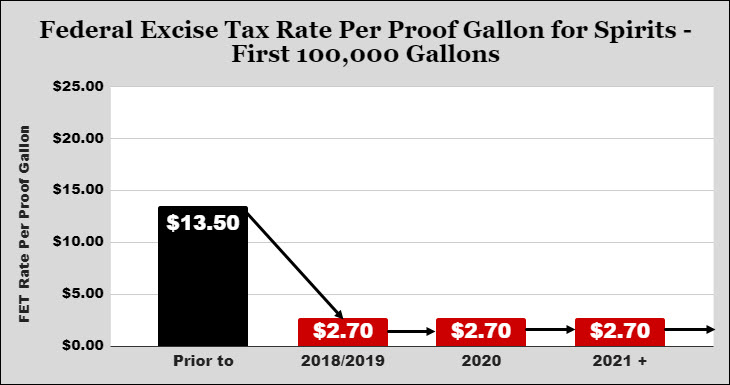

Under CBMTRA, distillers pay a reduced excise tax rate of $2.70 per proof gallon for the first 100,000 proof gallons of distilled spirits (most craft distillers fall into this category); a rate of $13.34 per proof gallon for the next 22,130,000 proof gallons of distilled spirits; and a rate of $13.50 per proof gallon for production in excess of 22,230,000 proof gallons.

“As President of ACSA and a craft spirits producer myself during what has arguably been the toughest year in recent history to be a small business owner, I know firsthand the struggles we all face in forecasting our financial futures,” said Becky Harris, President, ACSA and President, Catoctin Creek Distilling Company. “This passage is a major, monumental moment and the culmination of nearly a decade of craft spirits advocacy efforts.”

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Distillers Narrowly Avoid a 400% Tax Increase

Prior to passage of the new bill the American Craft Spirits Association, together with other major beverage industry groups, worked tirelessly to rally support for FET relief. CBMTRA had garnered tremendous bipartisan support with endorsement by more than three-fourths of the House and Senate.

Since 2011, craft spirits producers across the U.S. have rallied together in an effort to push forward long-term FET relief, and it is clear that this grassroots storytelling effort has worked. Over the past five years, ACSA has facilitated thousands of meetings with Members of Congress and their staffers. Even amid a COVID-19 shutdown, ACSA brought 150 craft spirits producers and the entire Board of Directors and Past Presidents to the Hill virtually to share their stories.

Margie A.S. Lehrman, CEO, ACSA: “As our country and industry face a challenging year ahead as we collectively recover from the direct, devastating impact on our businesses due to COVID-19 shutdowns, we applaud Congress — and in particular, Sen. Ron Wyden (D-OR) and Sen.Roy Blunt (R-MO) — for working together on both sides of the aisle to support our community of 2,200 small businesses and do what is vitally important to keep our industry afloat. This isn’t just a victory for our industry, but also the peripheral industries we support, including U.S. agriculture and hospitality. Today, we celebrate a major milestone in the fight for parity with craft beer and wine and thank the key Congressional leadership for their tireless efforts.”

Permanent Federal Excise Tax Reduction Chart: 2017 vs. 2021

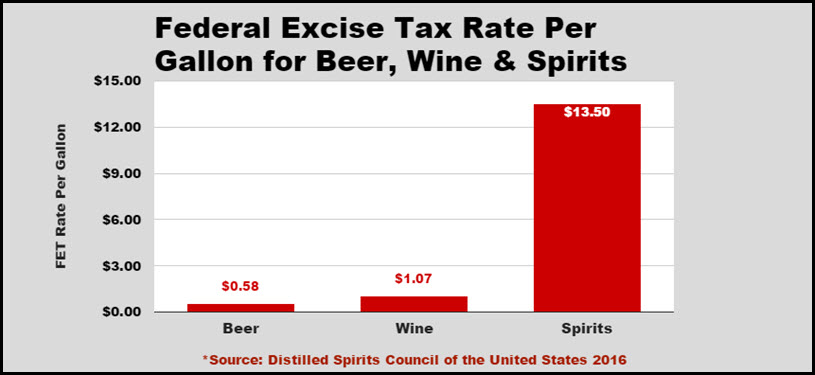

And if you are a visual person take a look at the two charts below. The first one shows the $13.50 Federal Excise Tax Rate prior to the tax reduction and the temporary and now permanent $2.70 per proof gallon for the first 100,000 proof gallons.

And as we talk about tax parity in the alcohol beverage market there has historically been a huge difference. Prior to tax relief beer makers were paying $.58 per proof gallon and wine makers were paying $1.07 per proof gallon while distillers were paying $13.50 per proof gallon. The temporary rate enacted in 2018 and now permanent is $2.70 per proof gallon for the first 100,000 proof gallons.

Bill Includes Additional Support for Many Small Businesses

In addition to CBMTRA, the year-end legislative package also includes measures such as additional Paycheck Protection Program (PPP) funding and a second draw for eligible small businesses; expanded PPP funding for eligible restaurants and bars; deductibility for expenses paid with the proceeds of a forgiven PPP loan; and an expanded business meal tax deduction to assist restaurants severely impacted by the COVID-19 crisis.

Related Stories

House Approves Package Making Distilled Spirits Reduced Federal Excise Tax Permanent – Step 1 of 3

Congress Approves Package Making Distilled Spirits Reduced Federal Excise Tax Permanent – Step 2 of 3

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.