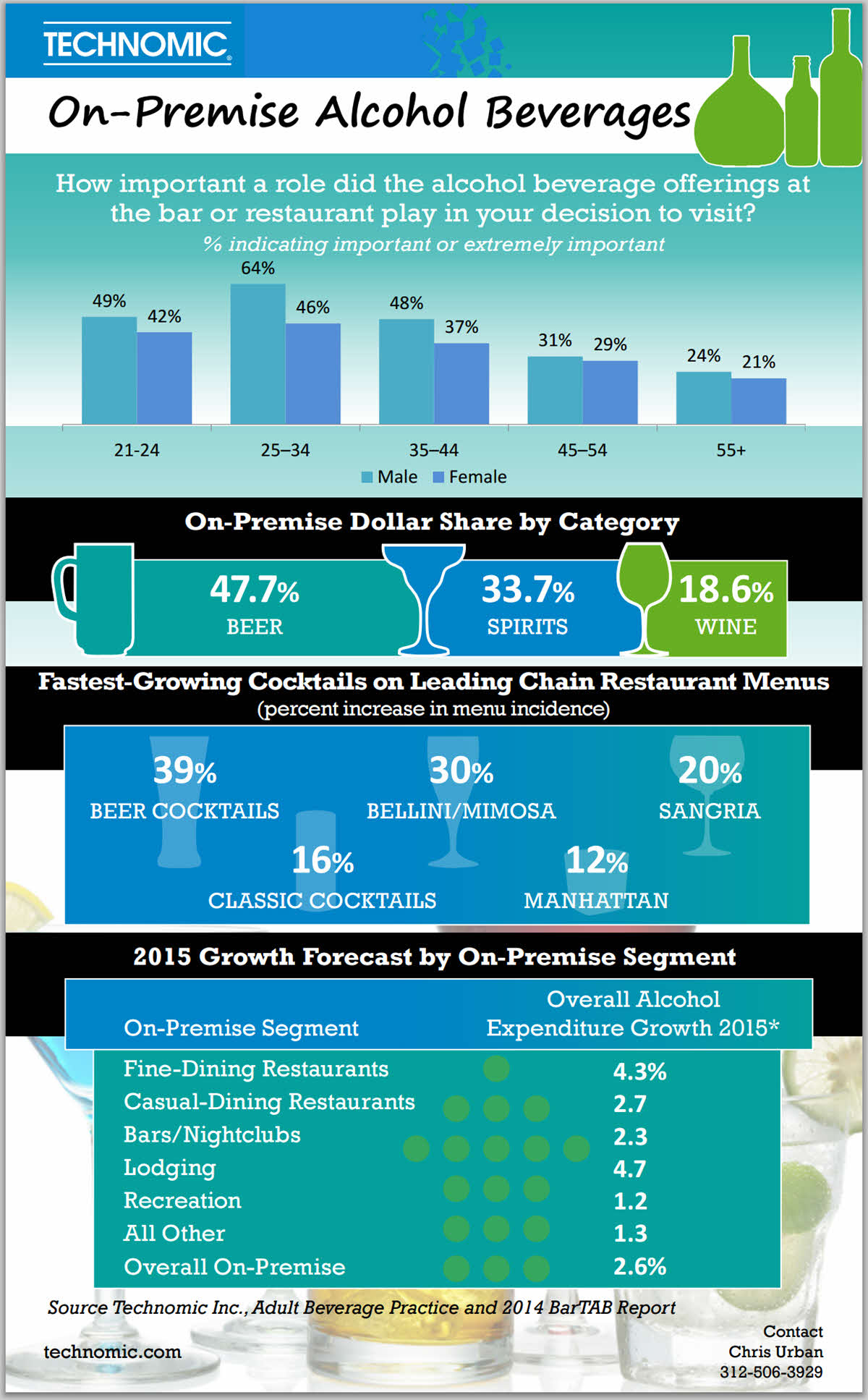

[vc_row][vc_column][vc_column_text]Drink sales in bars and restaurants are projected to grow modestly in 2015, according to Technomic’s expectations for the on-premise alcohol industry. Conditions at major chain restaurants that serve alcohol are slowly improving, and greater consumer confidence will lead to a more positive trend. The report calls for consumer expenditures on alcohol away from home to rise 2.7 percent in 2015, a slightly greater increase than is expected for alcohol expenditures at retail.

“Conditions are improving, and with lower gas prices and better consumer confidence, we’re continuing to see positive movement in consumer spending away from home,” states David Henkes, Vice President at Technomic and director of the firm’s adult beverage practice.

Stay Informed: Sign up here for our Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

In looking at specific adult beverage categories in on-premise channels, Technomic finds the largest category — beer — challenged in terms of volume. BarTAB Report outlines sales growth of 2.3% for beer in 2015, lower than the projections for wine and spirits.

2015 Growth Forecast by On-Premise Segment

On-Premise Segment Overall Alcohol Expenditure Growth 2015

Fine-Dining Restaurant 4.3%

Casual-Dining Restaurant 2.7%

Bars / Nightclubs 2.3%

Lodging 4.7%

Recreation 1.2%

All Other 1.3%

Overall On-Premise 2.6%

“Craft beer, cider and imports are generally doing well at the bar, but domestic beer, which accounts for nearly half of on-premise beer sales, continues to lose share,” observes Eric Schmidt, Director of Research at Technomic. Wine is expected to achieve the highest sales growth rate of the three adult beverage categories, with spirits a close second.

Technomic’s positive projection also comes with a note of caution. Alcohol sales will still lag broader restaurant and bar sales, due to fairly flat volume. “Dollar growth is driven largely by price increases and gains in certain categories such as craft beer and whiskeys including bourbon, Irish and single malt Scotch,” notes Henkes. “Bars and clubs, the segment that generates two-fifths of alcohol sales, is expected to underperform many other industry segments, holding down overall growth expectations.”

“We continue to stress to our clients the importance of a strong adult beverage program — it drives customer satisfaction, and it’s obviously a source of incremental profitability,” Henkes adds. “Many restaurant concepts that outperform the industry are emphasizing adult beverage, and we contend opportunities exist to leverage spirits, wine and beer to achieve greater traffic, sales and profits in 2015.”

Click here to see the full size Bar and Restaurant Alcohol Sales infographic.