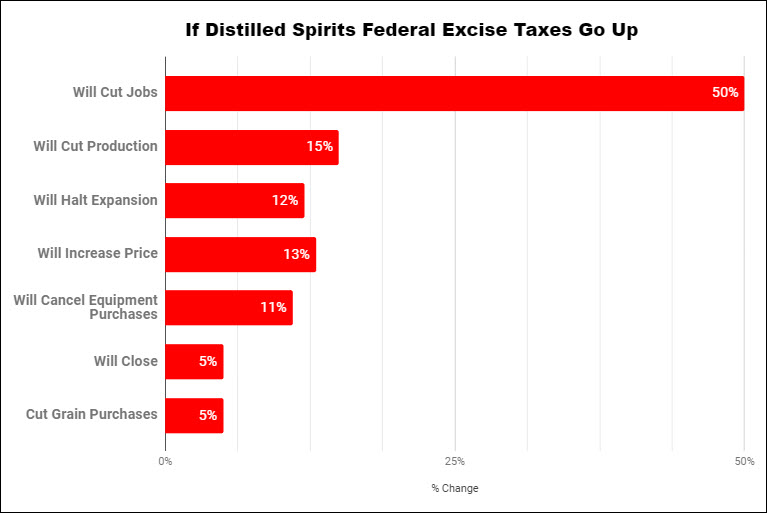

Though not a totally done deal, this news is very promising. The Distilled Spirits Council of the United States – DISCUS has released a statement saying the Craft Beverage Modernization and Tax Reform Act of 2019 may get a one year extension.

“We are thrilled that lawmakers included a one-year extension of the federal excise tax reduction for distillers in the year-end legislative package,” said Chris Swonger CEO of DISCUS. “While not yet a done deal, this is a significant relief for craft distillers across the country who were facing a 400 percent tax increase beginning January 1. We will continue to urge Congress to do the right thing, support small businesses and pass this critical piece of legislation.”

UPDATE 1: Under the legislation released, the federal excise tax reduction would expire on Dec. 31, 2020. The actual details of the latest amendment that would include a one-year extension are included below.

UPDATE 2: In a vote of 297 to 120 the House has passed the One-Year Extension of the Craft Beverage Modernization and Tax Reform Act. Next it’s on to the Senate and then finally President Trump to turn this into law.

“The distilled spirits industry is grateful for the House passage of a one-year extension of the Craft Beverage Modernization and Tax Reform Act, which will provide much-needed continued tax relief for more than 2000 craft distillers. This bill is critical to the day-to-day operations of craft distilleries nationwide, and its passage will be instrumental in their planning for the next year. We urge the Senate to pass this legislation swiftly to restore stability for these small businesses as soon as possible.”

Get the full details of the 2019 Craft Beverage Modernization and Tax Reform Act here.

SEC. 144. CERTAIN PROVISIONS RELATED TO BEER, WINE, AND DISTILLED SPIRITS.

(a) EXEMPTION FOR AGING PROCESS OF BEER, WINE, AND DISTILLED SPIRITS.—

(1) IN GENERAL.—Section 263A(f)(4)(B) is amended by striking ‘‘December 31, 2019’’ and inserting ‘‘December 31, 2020’’.

(2) EFFECTIVE DATE.—The amendment made by this subsection shall apply to interest costs paid or accrued after December 31, 2019.

(b) REDUCED RATE OF EXCISE TAX ON BEER.—

(1) IN GENERAL.—Paragraphs (1)(C) and

(2)(A) of section 5051(a) are each amended by striking ‘‘January 1, 2020’’ and inserting ‘‘January 1, 2021’’.

(2) EFFECTIVE DATE.—The amendments made by this subsection shall apply to beer removed after December 31, 2019.

(c) TRANSFER OF BEER BETWEEN BONDED FACILI16 TIES.—

(1) IN GENERAL.—Section 5414(b)(3) is amended by striking ‘‘December 31, 2019’’ and in19 serting ‘‘December 31, 2020’’.

(2) EFFECTIVE DATE.—The amendment made by this subsection shall apply to calendar quarters beginning after December 31, 2019.

(d) REDUCED RATE OF EXCISE TAX ON CERTAIN WINE.—

(1) IN GENERAL.—Section 5041(c)(8)(A) is amended by striking ‘‘January 1, 2020’’ and insert3 ing ‘‘January 1, 2021’’.

(2) CONFORMING AMENDMENT.—The heading of section 5041(c)(8) is amended by striking ‘‘SPE6 CIAL RULE FOR 2018 AND 2019’’ and inserting ‘‘TEMPORARY SPECIAL RULE’’.

(3) EFFECTIVE DATE.—The amendments made by this subsection shall apply to wine removed after

10 December 31, 2019.

(e) ADJUSTMENT OF ALCOHOL CONTENT LEVEL FOR APPLICATION OF EXCISE TAXES.—

(1) IN GENERAL.—Paragraphs (1) and (2) of section 5041(b) are each amended by striking ‘‘Jan15 uary 1, 2020’’ and inserting ‘‘January 1, 2021’’.

(2) EFFECTIVE DATE.—The amendments made by this subsection shall apply to wine removed after 18 December 31, 2019.

(f) DEFINITION OF MEAD AND LOW ALCOHOL BY VOLUME WINE.—

(1) IN GENERAL.—Section 5041(h)(3) is amended by striking ‘‘December 31, 2019’’ and inserting ‘‘December 31, 2020’’.

(2) EFFECTIVE DATE.—The amendment made by this subsection shall apply to wine removed after December 31, 2019.

(g) REDUCED RATE OF EXCISE TAX ON CERTAIN DISTILLED SPIRITS.—

(1) IN GENERAL.—Section 5001(c)(4) is amended by striking ‘‘December 31, 2019’’ and in8 serting ‘‘December 31, 2020’’.

(2) CONFORMING AMENDMENT.—The heading of section 5001(c) is amended by striking ‘‘RE11 DUCED RATE FOR 2018 AND 2019’’ and inserting ‘‘TEMPORARY REDUCED RATE’’.

(3) EFFECTIVE DATE.—The amendments made by this subsection shall apply to distilled spirits re15 moved after December 31, 2019.

(h) BULK DISTILLED SPIRITS.—

(1) IN GENERAL.—Section 5212 is amended by striking ‘‘January 1, 2020’’ and inserting ‘‘January 1, 2021’’.

(2) EFFECTIVE DATE.—The amendment made by this subsection shall apply to distilled spirits transferred in bond after December 31, 2019.

(i) SIMPLIFICATION OF RULES REGARDING RECORDS, STATEMENTS, AND RETURNS.—

(1) IN GENERAL.—Section 5555(a) is amended by striking ‘‘January 1, 2020’’ and inserting ‘‘January 1, 2021’’.

(2) EFFECTIVE DATE.—The amendment made by this subsection shall apply to calendar quarters beginning after December 31, 2019.

(j) TECHNICAL CORRECTION.—

(1) IN GENERAL.—Section 5041(c)(8) is amended by adding at the end the following new subparagraph:

‘‘(C) APPLICATION OF CERTAIN RULES.— Paragraphs (3) and (6) shall be applied by substituting ‘paragraph (1) or (8)’ for ‘paragraph

(1)’ each place it appears therein.’’.

(2) EFFECTIVE DATE.—The amendment made by this subsection shall take effect as if included in section 13804 of Public Law 115-97.

We’ll continue to update this story. Cheers!

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.