As the end of 2020 nears distillers across the country face a dire 400% tax increase unless Congress acts. In late 2017 Congress voted to approve the Craft Beverage Modernization and Tax Reform Act – CBMTRA. At the time the Act was only approved to reduce taxes for two years.

For many family run craft distilleries it meant they could take a paycheck for the first time since opening their small business. For others it meant they could finally hire a full-time sale manager that they could never afford previously. And for others it meant they could finally afford that new copper column still or other equipment they needed to take their business to a new level.

Distillers fought to get that bill made permanent in 2019. Instead, Congress approved another temporary approval of the Act but this time it was only for 12 months. Unfortunately, those 12 months have flown by and are coming to a close on December 31, 2020 at midnight. With a pending tax increase and reduced sales because of the pandemic consequences of not renewing or making the CBMTRA permanent could be devastating for hundreds of small craft spirits makers if Congress does not act in the next few weeks.

CEOs of Major Beverage Alcohol Associations Send Letter to Congress Urging Immediate Passage of CBMTRA

Chief executive officers from eight major beverage alcohol associations sent a letter to Congressional Majority Leader McConnell, Speaker Pelosi, Minority Leader Schumer and Leader McCarthy urging immediate passage of the bipartisan Craft Beverage Modernization and Tax Reform Act, S. 362/H.R. 1175 (CBMTRA) to keep craft distillers, brewers, vintners, cider producers and mead makers from suffering a devastating tax hike in January.

The coalition letter was signed by CEOs from the Distilled Spirits Council of the United States – DISCUS, American Craft Spirits Association – ACSA, Beer Institute, Brewers Association, Wine Institute, WineAmerica, The American Cider Association and American Mead Makers Association.

“Now, weeks away from a federal excise tax increase, producers fear their businesses will not be able to shoulder another burden after such a challenging year,” said the coalition. “Unlike other tax provisions, absent Congressional action, the increase in federal excise taxes will have an immediate impact on the industries.”

In 2018, the beverage alcohol industry supported more than 5.4 million jobs across the country and generated more than $562 billion in economic activity.

“This year, producers across the country have seen dramatic declines in revenue, suspended production, furloughed or laid-off employees, and closed their doors to visitors,” the coalition said. “These changes have impacted not only the livelihoods of their employees – but also the livelihoods of farmers, distributors, truck drivers, warehouse workers and countless others connected to the industries.”

Introduced by Senators Ron Wyden (D-Ore.) and Roy Blunt (R-Mo.) and by Representatives Ron Kind (D-Wis.) and Mike Kelly (R-Pa.), CBMTRA will make permanent reforms enacted in 2017 that create a fair and equitable tax structure for brewers, winemakers, distillers and importers of all beverage alcohol. The bill currently has 351 cosponsors in the House and 77 in the Senate.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Small Business Owners Across U.S. React

The letter also featured comments from owners of small distilleries, breweries and wineries underscoring the urgency of the legislation’s passage.

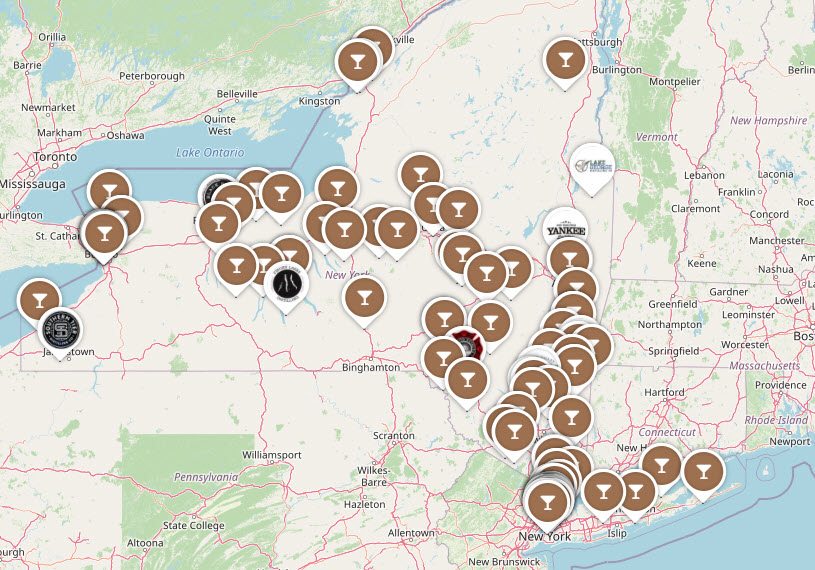

New York

“When our local community needed us, we leapt into action and delivered over 405,000 bottles of hand sanitizer (or 300 million hand washes) to individuals across the state,” said Jason Barrett, president of Black Button Distilling in Rochester, New York. “Our employees have been working seven days a week, up to 20 hours a day regardless of the weather conditions fighting for their community with the knowledge that many lives and livelihoods depend on it. At the same time, we have already lost 40 percent of our staff this year from unavoidable cuts. With the loss of our offsite division, tasting room revenue, and decreased sales to bars and restaurants, we just could not afford to keep them. We were forced to cut back our production of spirits by over 50 percent, which hurts our farmers, glass suppliers, and label producers and other partners. We have slashed budgets across the company trying to stem the bleeding, but if this federal excise tax increase moves forward, the additional loss next year could cost upwards of four or more additional jobs.” View all New York Distilleries.

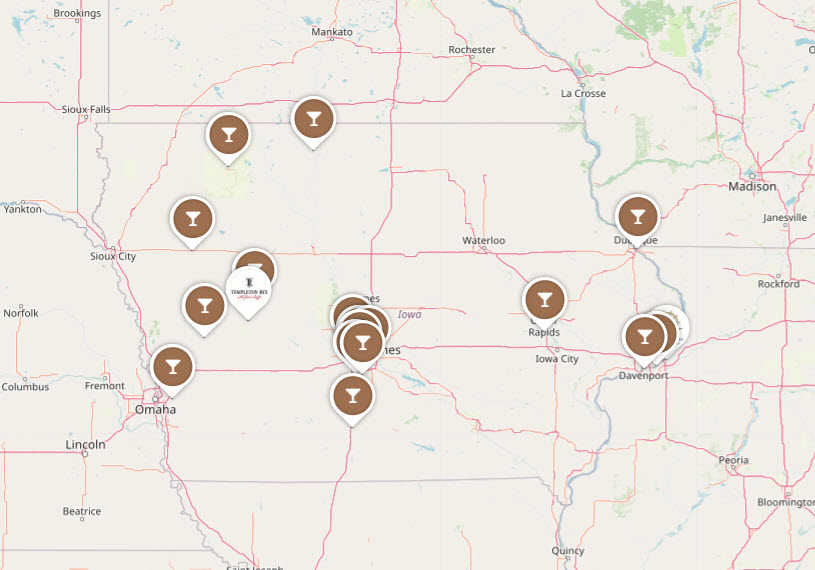

Iowa

“As we attempt to finalize our business plans for 2021, there is no matter more urgent to us both here at home in Iowa and to our broader craft distilling industry than making permanent the reduced FET rate we have received for the last three years — one that previously didn’t exist for small distillers,” said Jeff Quint, owner and founder of Cedar Ridge Distillery in Swisher, Iowa. “In its first two years, this critical savings allowed us to reinvest in our small businesses and support peripheral industries, like U.S. agriculture, hospitality and tourism, and manufacturing; but this year, the reduced rate has merely helped keep our businesses afloat as we attempt to survive. If we receive the 400 percent tax increase slated for January 1, 2021, we will almost certainly face more company debt and sweeping layoffs.” View all Iowa Distilleries.

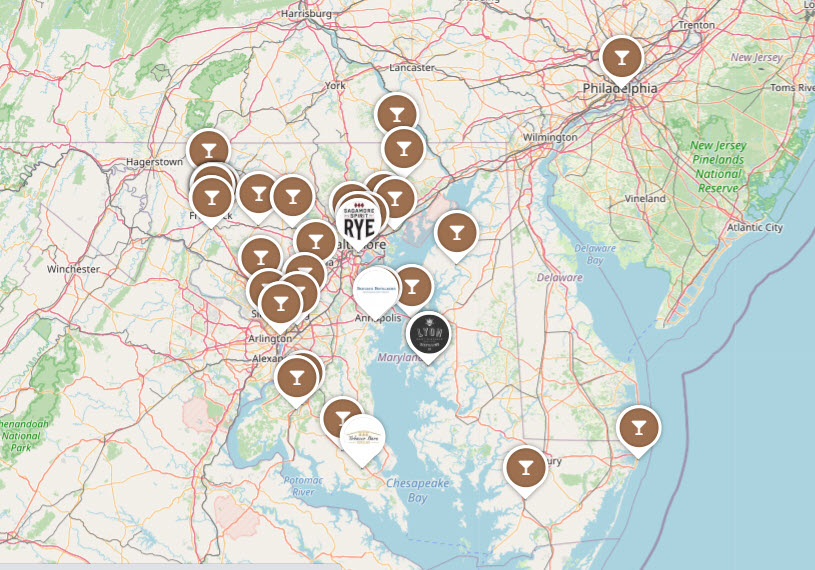

Maryland

“The COVID-19 pandemic has resulted in dramatic losses for brewers and beer importers,” said Dan Kopman, CEO of Heavy Seas Beer & E.Krisper’s Cider in Baltimore, Maryland. “Specifically, our volume is down 15 percent, and our revenue is down 20 percent as we had to close our taproom. Expiration of CBMTRA will be a further kick in the gut when we can least afford it.” View all Maryland Distilleries.

Missouri

“The money that we have saved through the recalibrated excise tax has helped us keep people employed during the pandemic,” said Jeff Schrag, founder and owner of Mother’s Brewing Co. in Springfield, Missouri. “As we budget for next year, we are re-evaluating staffing levels, and this is a big question mark. Yes, we can keep our current staff if the recalibration continues, if not, we likely would need to shed one full-time employee. We just do not have a cushion.” View all Missouri Distilleries.

California

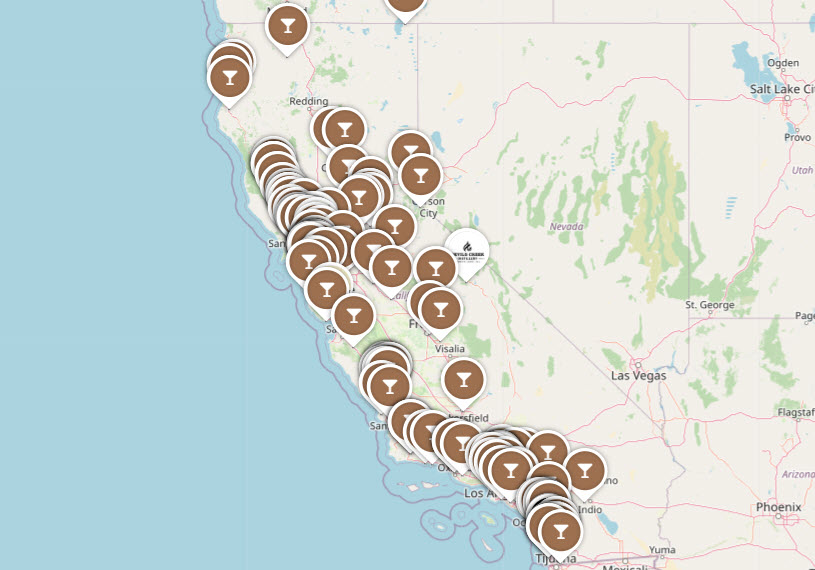

“Like others across our great state of California, we have faced multiple challenges throughout the year as a result of the COVID-19 pandemic and wildfires that ravaged Napa Valley and other major grape growing regions,” said Robin Baggett, managing partner of Alpha Omega Winery in Rutherford, California. “We managed to stay afloat by launching virtual tastings and expanding online sales, and we’ve worked to support the restaurants and small businesses in our community. But now the future of our industry is at stake. Increased excise taxes combined with another round of mandated tastings room closings, growing operating costs as a result of the pandemic and wildfire damage to vineyards, buildings, barrels, equipment and inventory will be too much to bear.” View all California Distilleries.

Oregon

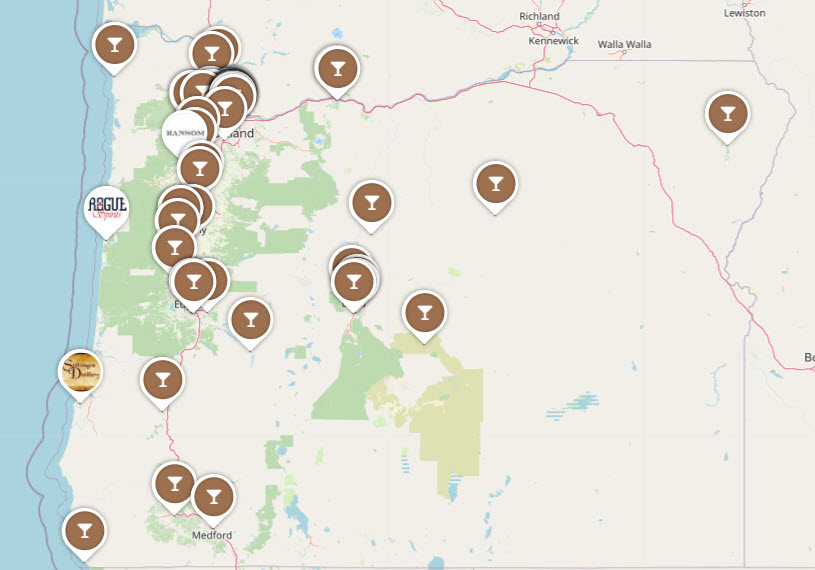

“As a medium-sized, family-owned and operated winery in the Willamette Valley, we have been hit hard in 2020,” said Janie Brooks Heuck, chair of WineAmerica and managing director of Brooks Winery in Amity, Oregon. “Starting with the shutdowns in March, we immediately lost 70 percent of our revenue streams from restaurants across the country and our tasting room. Now, we are back to day-to-day mandates about being able to have our tasting room open, or outside only service for the winter. With no relief beyond the initial round of PPP loans, having our federal excise taxes going back up in 2021 will be crippling and an extra burden that many, including our winery, likely will not be able to handle.” View all Oregon Distilleries.

Michigan

“There is normal uncertainty in any business and there are risks involved when chasing the American Dream,” said John Behrens board member of the American Cider Association and founder and president of Farmhaus Cider in Grand Rapids, Michigan. “That risk and uncertainty is understandable and necessary. What we currently face through the artificial uncertainty created by the lack of resolution regarding the CBMTRA’s permanence is different, however. We need urgent resolution. Cider is the quintessential small business American dream success story built on local agriculture and community. If that’s not worth working to save, what is? The failure to make the CBMTRA permanent now would be a crushing blow to our cider business and several hundred others just like us.” View all Michigan Distilleries.

Pennsylvania

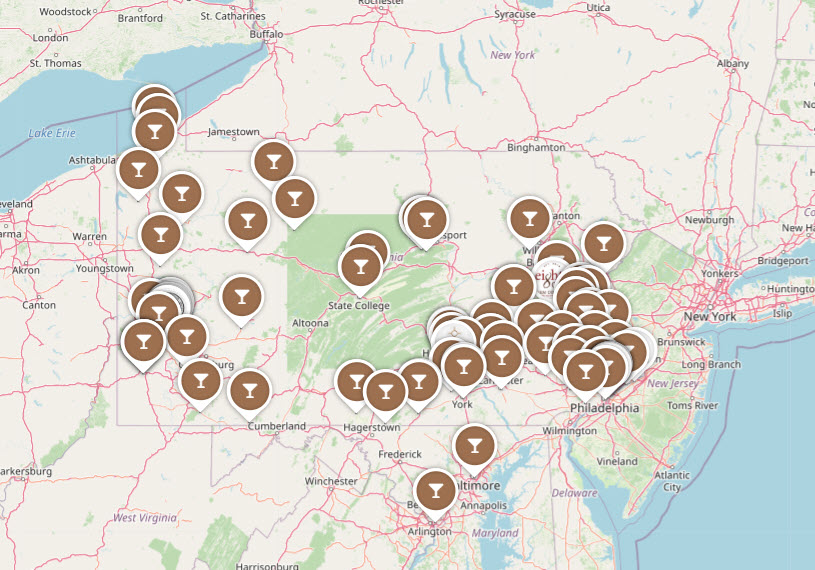

“2020 has been a challenge for everyone, but it has hit the alcohol manufacturers in their hearts and their wallets,” said Brandalynn Armstrong, business development manager of Upper Reach Meadery in Phoenixville, Pennsylvania. “March marked a drastic change in our industry, as well as those in the service industry that support us. Relief for everyone affected by the COVID-19 pandemic is not feasible, and a lot of us will not survive, but including the Craft Beverage Modernization and Tax Reform Act in the next legislative package would be the life support that will help us live to brew another day.” View all Pennsylvania Distilleries.

Below are the contacts for each of the organizations if you need additional information or would like to find out what additional steps you can take to make a difference in this very important topic.

Related Stories

Distilleries See a Reduction of 31% in their workforce and a loss of $700 million in sales (2020)

President Signs 1-Year Extension of the Craft Beverage Modernization and Tax Reform Act (2019)

Senate & House Pass Bills Including Craft Beverage Modernization & Tax Reform – 1 Step Remains (2017)

Breaking: The Tax Bill Including Craft Beverage Modernization & Tax Reform Has Passed (2017)

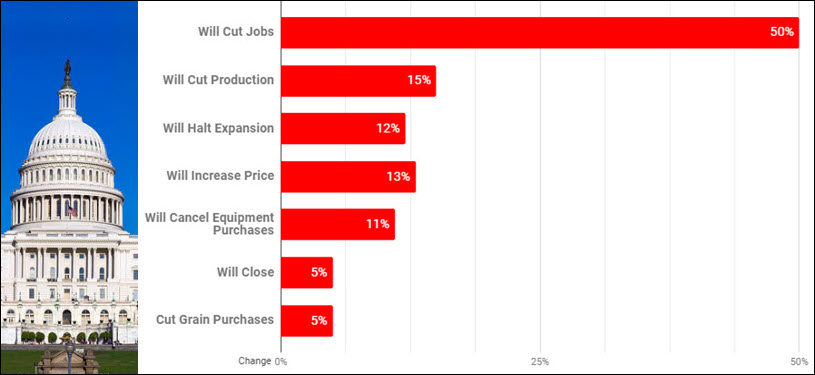

Source: Data for cover image based on a Dec. 2019 American Craft Spirits Association member survey. “How will an increase in the FET effect your craft spirits distillery?”

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.