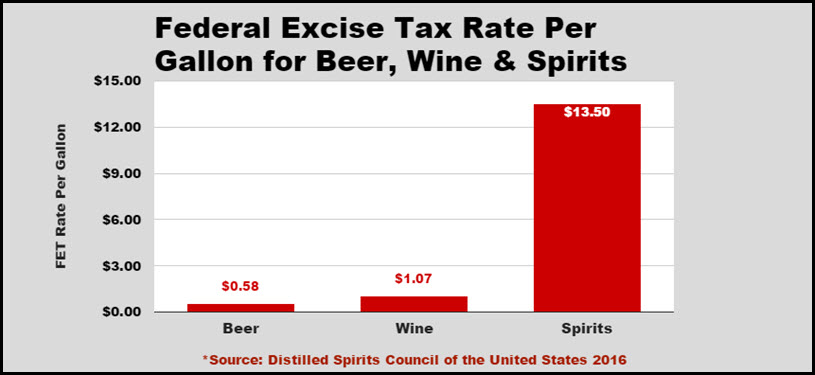

Craft brewers and small vintners have enjoyed a lower federal excise tax rate based on their smaller size for many years. Craft distillers however have not had the luxury of such a law and are required to pay the identical tax rates to the big distilled spirits makers. The Craft Beverage Modernization and Tax Reform Act legislation would for the first time create a reduced Federal Excise Tax (FET) for craft distillers producing less than 100,000 proof gallons of spirits a year.

S.236, the Craft Beverage Modernization and Tax Reform Act, re-introduced earlier this year by Sen. Ron Wyden (D-OR) and Sen. Roy Blunt (R-MN) is trying to change that. The bill recently reached a landmark 50 co-sponsors in the Senate, with 28 Democrats, 21 Republicans and one Independent, representing a clear, bipartisan groundswell of support for tax parity.

H.R. 747, the companion bill introduced by Rep. Erik Paulsen (R-MN) and Rep. Ron Kind (D-WI) in the U.S. House of Representatives, which reached a majority back in June 2017, continues to rally support as well, with 278 co-sponsors including three new co-sponsors gained this September.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

The craft distilling industry is growing, with, on average, one distillery opening per day. There are more than 1,500 craft spirits distilleries operating in the U.S. in all 50 states, employing well more than 12,000 people. Investments in the industry in the last decade have now reached over $300 million, according to the Craft Spirits Data Project (2016).

There are several things in the bill but by far, the biggest single item for craft distillers is the reduction in the Federal Excise Tax (FET) rate. The bill is asking for a reduction from $13.50 to $2.70 for the first 100,000 proof gallons of spirits.

Mark Shilling Managing Principal of Shilling/Crafted and President of the American Craft Spirits Association said, “This Senate majority landmark of support for the Craft Modernization and Tax Reform Act, coupled with the milestone majority reached in the House back in June, represents a resounding recognition by Congress that parity in the tax code for craft distillers is critical to the future growth of our industry. Fair and equal application of the federal excise tax will bring parity to all small and independent manufacturers in our industry and will ensure the continued growth and entrepreneurial spirit of craft distillers.“

Margie A.S. Lehrman, Executive Director of American Craft Spirits Association, said, “Now that there is a clear consensus for FET reduction, the Association will call on leadership to ensure this critical reform is included in the forthcoming tax bill. We are optimistic about this progress to date, but our fight will not end until we have achieved tax reform to better enable our nation’s nascent but growing craft businesses to succeed.”

The American Craft Spirits Association is the only registered non-profit trade association representing the U.S. craft spirits industry. Its mission is to elevate and advocate for the community of craft spirits producers, and membership in ACSA is open to anyone.

Related Stories

Craft Spirits Makers 2017 D.C. Fly-In to Support Craft Beverage Modernization & Tax Reform [Agenda]

Virginia Distillers Association in D.C. to Support Craft Beverage Modernization & Tax Reform

HR 747 Craft Beverage Modernization & Tax Reform Reaches Majority in House

Craft Beverage Modernization & Tax Reform Act to Help Beer, Cider, Wine & Distilled Spirits Industries

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.