The Distilled Spirits Council of the United States – DISCUS the leading voice and advocate for distilled spirits celebrated their 2nd annual conference in Austin, Texas this week.

The conference is comprised of large heritage distillers as well as craft spirits makers from across the United States and the entire world. One of the many topics covered at the event is the continued growth in the luxury brands and the growth of premiumization of distilled spirits.

At this year’s event DISCUS announced it was creating the first Luxury Brand Index – LBI. It’s a new tool to analyze sales of spirits brands at the top end of the distilled spirits market.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

DISCUS Senior Vice President for Economic and Strategic Analysis David Ozgo introduced the new LBI tracks that include sales of brands in six major spirits categories that sold for a retail price of $50 or more for a 750 ml bottle. Price points for this segment of the market are more than three times that of the typical bottle and account for only 3-4% of total spirits volume. This represents approximately 105 million bottles sold, totaling more than $10 billion at retail.

DISCUS ‘Luxury Brand Index’ Covers American, Japanese, and Irish Whiskey, Scotch, Tequila & Cognac

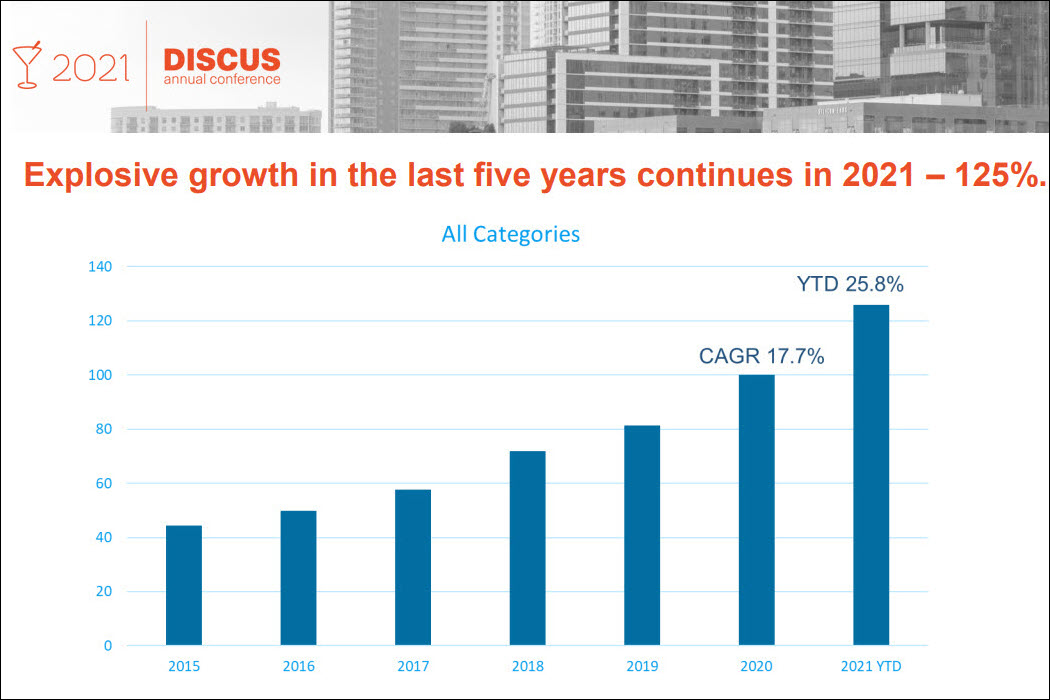

“Across all major spirits categories, consumers are captivated by the quality, exclusivity and heritage of luxury brands,” said Ozgo. “The sale of luxury spirits brands has spiked 125 percent between 2015 and 2020, and demand for these prestige products is growing.”

The new LBI index includes sales of Cognac, American whiskey, Irish whiskey, Single Malt Scotch, Japanese whisky and Tequila from the past five years.

Key Luxury Brand Index Findings

- Luxury spirits brands have grown in volume by 125% between 2015 and 2020.

- This represents an annual growth rate of 17.7%; far greater than the 2.5% rate seen across all spirits brands.

- Continuing the upward trend,through the first half of 2021, volumes of luxury spirits brands are up nearly 25%.

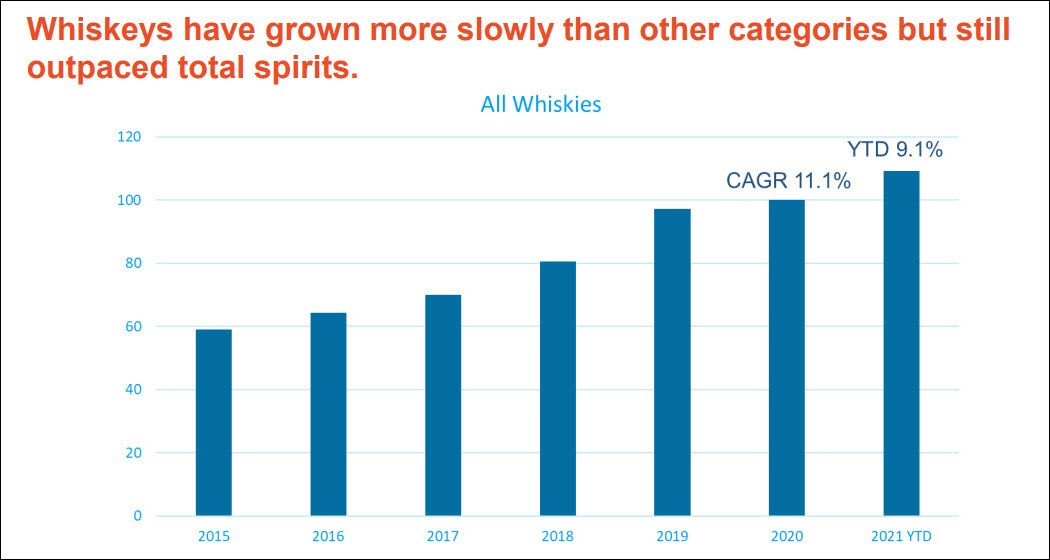

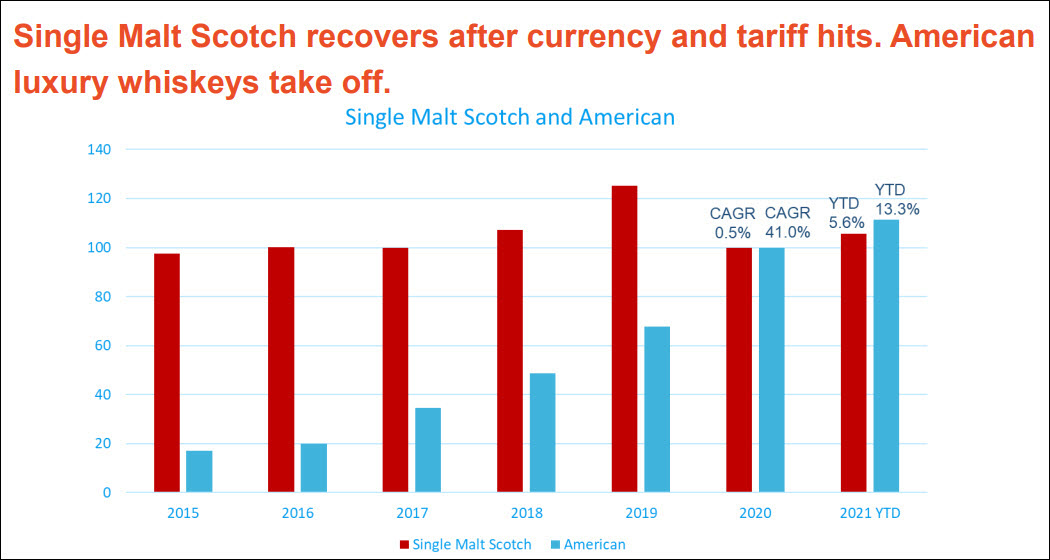

- Luxury whiskeys have grown more slowly than the other categories but still outpace the growth of the total spirits sector with an annual growth rate of 11.1%.

Category Highlights

American Whiskey – America’s native spirits have been enjoying a resurgence over the past decade, and new luxury segments of the American whiskey category have emerged. These include Bourbon, Tennessee whiskey, Rye and American single malts. Since 2015, the luxury American whiskey category has grown at an annual rate of 41 percent. Now totaling approximately 6 million bottles.

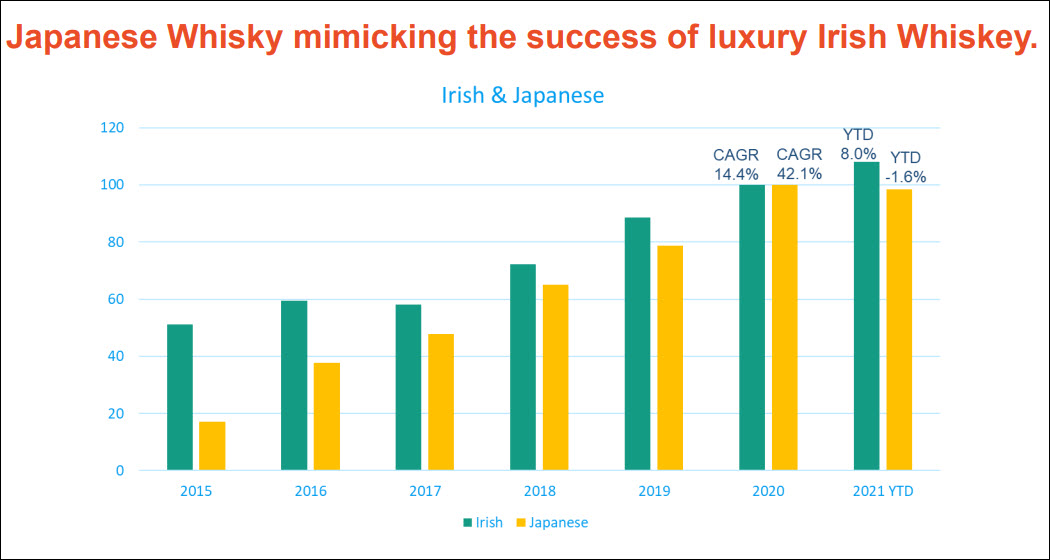

Japanese Whisky – Americans renewed fondness for whiskey has helped Japanese whisky gain a strong foothold in the U.S. market in recent years. Many Japanese whiskies are luxury priced, and the segment grew at an annual rate of 42 percent between 2015 and 2020. Now totaling nearly 2 million bottles.

Irish Whiskey – Irish whiskey has enjoyed rapid growth in the U.S. climbing at a rate of more than 14 percent annually since 2015. Now totaling more than 1 million bottles.

Single Malt Scotch – Single malt scotch, with itslong and rich history, has many luxury priced brands. In recent years, currency fluctuations and tariffs have presented challenges, but through the first six months of 2021, the luxury segment has returned to strong volume growth of 5.6 percent. Now totaling nearly 9 million bottles.

Tequila – It has only been within the last 10 years that Americans have developed an appreciation for 100 percent blue agave tequilas. Since 2015, this new luxury category has enjoyed an annual growth rate of 30.7 percent. Now totaling nearly 28 million bottles.

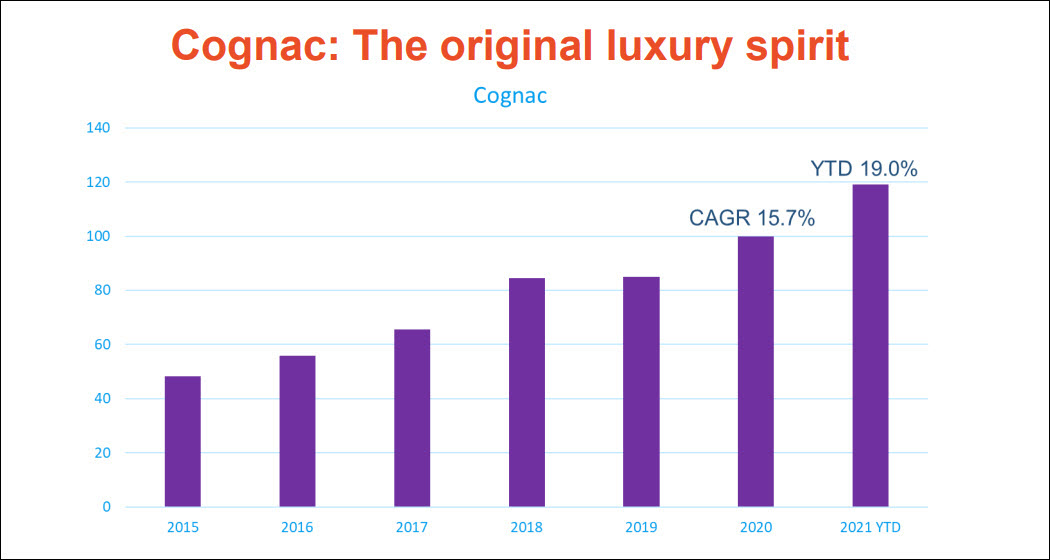

Cognac – Cognac is one of the traditional luxury spirits. While well established for decades, luxury priced Cognacs grew at an annual rate of almost 16 percent since 2015. Now totaling nearly 29 million bottles.

As part of the media briefing, Ozgo also hosted a panel discussion on the booming luxury market with spirits industry experts representing iconic and new luxury spirits brands. Panelists included Derek Ruediger, vice president of Hennessy Brand Marketing; Dia Simms, CEO of Lobos 1707 Tequila; and Raul Gonzalez, managing director of Edrington USA. You can watch the entire presentation of the Luxury Brand Index discussion from the DISCUS 2nd Annual Conferent in the video below.

The LBI will be released quarterly to provide insight to the beverage business community, analysts, and media. Retail prices were calculated by IRI Worldwide using retail scanner data. Volumes were derived from the Distilled Spirits Council’s proprietary brand data.

View all Austin Distilleries.

View all Texas Distilleries.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.