The Distilled Spirits Council of the United States (DISCUS) has released its 2016 economic briefing to for the media and Wall Street analysts. The latest report continues to show positive growth in both sales and volume for the industry. The sector shows supplier sales up 4.5 percent to $25.2 billion, volumes up 2.4 percent to 220 million cases and a seventh straight year of market share gains relative to beer.

Distilled Spirits Council President and CEO Kraig R. Naasz

“The continued growth of the spirits sector clearly demonstrates that adult consumers’ taste for, and interest in premium distilled spirits, across all categories, is trending upward,” said Distilled Spirits Council President and CEO Kraig R. Naasz. “Spirits makers continue to develop new innovations to appeal to a growing audience of adult millennials, and they are responding by purchasing and enjoying our products.”

Naasz cited recent public opinion research, which showed 78 percent of the public view the spirits sector favorably and a significant majority support sales of spirits in grocery stores, as well as equal taxes and the same regulations for spirits, beer and wine.

“Our sector is viewed favorably by the majority of the public, which also thinks we should be treated equally with respect to regulation and taxation,” said Naasz. “From a public policy standpoint, our goal is to continue to modernize the marketplace and provide consumers with the choices and convenience they seek when it comes to spirits.”

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

American Whiskey Boom Continues

The Council estimates that overall retail sales of distilled spirits in the U.S. market reached nearly $78 billion in 2016, supporting more than 1.4 million jobs in the hospitality and manufacturing sectors.

American whiskey – Bourbon, Tennessee and Rye – continued to captivate U.S. consumers. Several other spirits categories also performed exceptionally well in the U.S. market including:

- American whiskey volumes up 6.8 percent to 21.8 million cases and revenues up 7.7 percent to $3.1 billion.

- Cognac volumes up 12.9 percent to 5.1 million cases; revenues up 15.3 percent to $1.5 billion;

- Irish Whiskey volumes up 18.7 percent to 3.8 million cases; revenues up 19.8 percent to $795 million;

- Tequila volumes up 7.1 percent to 15.9 million cases; revenues up 7.5 percent to $2.5 billion; and importantly,

- Vodka volumes, which represent one-third of all spirits volumes, up 2.4 percent to 69.8 million cases; revenues up 4.1 percent to $6 billion.

The spirits sector’s strong performance in 2016 resulted in market share gains relative to beer for the seventh straight year, as reported by Council Chief Economist David Ozgo. Spirits’ market share increased by one-half a point to 35.9 percent. Each point of market share is worth approximately $700 million in supplier revenue.

Ozgo cited key factors contributing to the spirits sector’s continued growth, including:

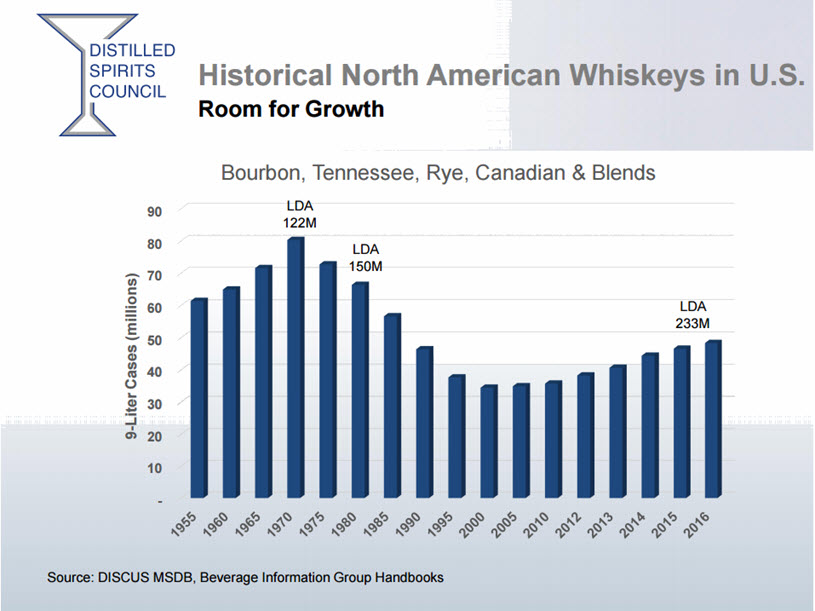

- The American Whiskey trend has plenty of room for growth as the country trends back toward historic levels of whiskey consumption (see chart below);

- Cocktails are exceptionally well-positioned to meet adult millennials’ demand for unique and varied experiences;

- Spirits fit nicely into the trend of consumer interest in brands with authentic, interesting backstories;

- Local distilleries are driving modernization of state and local laws and generating excitement in the overall spirits category; and

- Spirits have become a fixture in popular culture and are part of the norm.

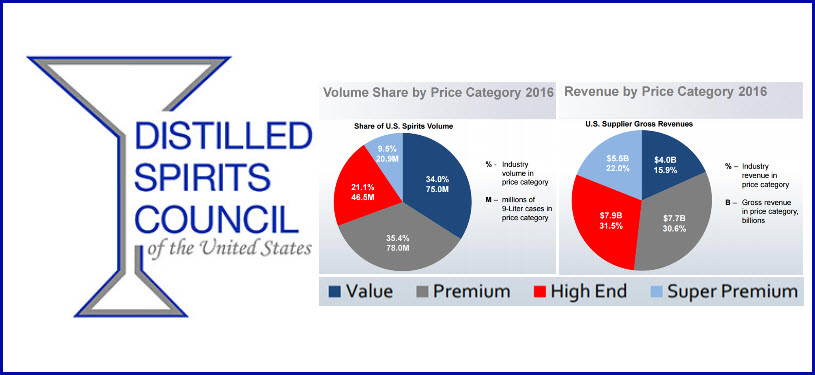

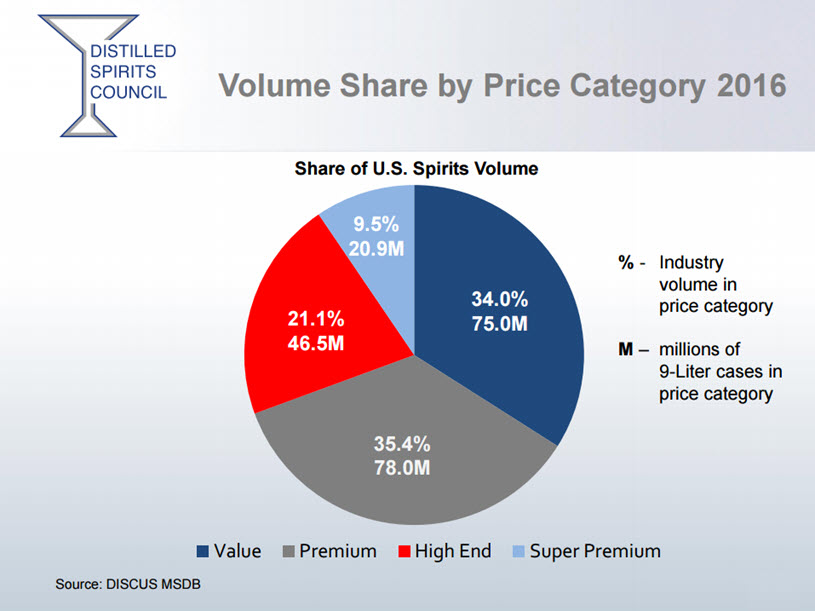

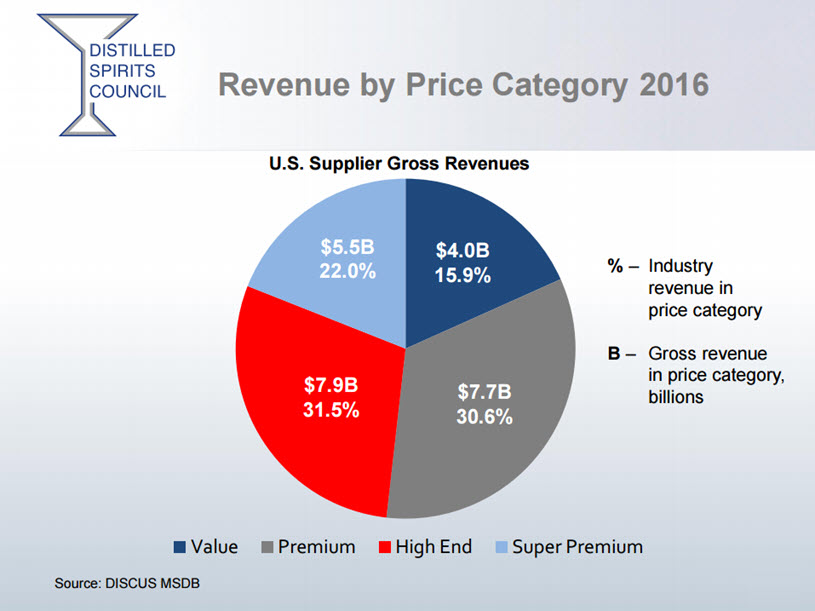

Price Segments by Volume Share & Revenue

Price Segments by Volume Share & Revenue

[table “” not found /]

Distilled Spirits Export Volume Growth Continues Despite Strong Dollar

Total U.S. spirits export volumes increased 6.8 percent in 2016, driven largely by American whiskey – Bourbon, Tennessee and Rye – which increased 10.2 percent in 2016.

Distilled Spirits Council Senior Vice President for International Affairs Christine LoCascio attributed the volume growth to global fascination with the American Whiskey story; the exporting of cocktail culture; and the mixabililty and versatility of America’s native spirit.

Top Export Markets for Distilled Spirits

The 2016 top five export growth markets by value were: Vietnam, up $29.2 million USD to a total of $45.9 million USD; Spain, up $18.6 million USD to reach $104.1 million USD; France, up $9.7 million USD to $97.6 million USD; Singapore up $4.5 million USD to reach $30.7 million USD; and Romania up $2.4 million USD to a total of $10.6 million USD.

2016 Distilled Spirits Policy Achievements

2016 was a significant year of growth for the Council as membership climbed to more than 150 distillers for the first time. “In bringing together companies of all sizes to support the spirits sector, we were able to advance our agenda at the local, state, federal and international levels,” said Naasz.

Local Distilleries Drive Interest in Overall Spirits Category

There are now more than 1,300 craft spirit distilleries across the country. As craft spirits makers multiply more legislators will listen (to those that got them elected) as they try to help small businesses startup and prosper.

Naasz highlighted the passage of spirits sales in Colorado grocery stores, the defeat of tax increases in 10 states, victories in 21 wet/dry elections, improved tastings laws and the passage of multiple “Brunch Bills” permitting patrons to order cocktails before 1 p.m.

At the federal level, the Council-led coalition of beverage alcohol organizations continues to build support for a reduction in the federal excise tax on spirits, beer and wine. The coalition secured a majority of both the U.S. House of Representatives and U.S. Senators as co-sponsors last Congress and is heralding the re-introduction of the Craft Beverage Modernization & Tax Reform Act in this Congress. This Council-led effort is well positioned to achieve federal excise tax relief as part of an overhaul of the nation’s tax code in the new Congress.

Key Points of the Craft Beverage Modernization & Tax Reform Act

- Supported by majority of lawmakers in both houses last session

- Lowering FET will spur investment and job creation at distilleries

- First time taxes on distilled spirits could be reduced since the Civil War

Also of significance in 2016, important social responsibility progress continued in the United States with the latest government statistics showing underage drinking and binge drinking at historic lows and a continued downward trend in rates of driving under the influence of alcohol.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.

Resource: Distilled Spirits Council of the United States, 2016 Economic Briefing, February 7, 2017