Once again, the No. 1 distilled spirit brand in the world is one that most American’s have never heard of. It’s so large and so dominate that it exceeds the totals of the No. 2 and No. 3 brands combined.

This year’s IWSR Top 100 list brings into focus the defining role that emerging markets play in shaping the global spirits industry. The drinking population in India, Brazil and South East Asia, in particular, is growing each year. This keeps Indian whiskies, cachaça and soju/shochu brands in high positions on the list; population growth and wider distribution also help international brands to reach new consumers.

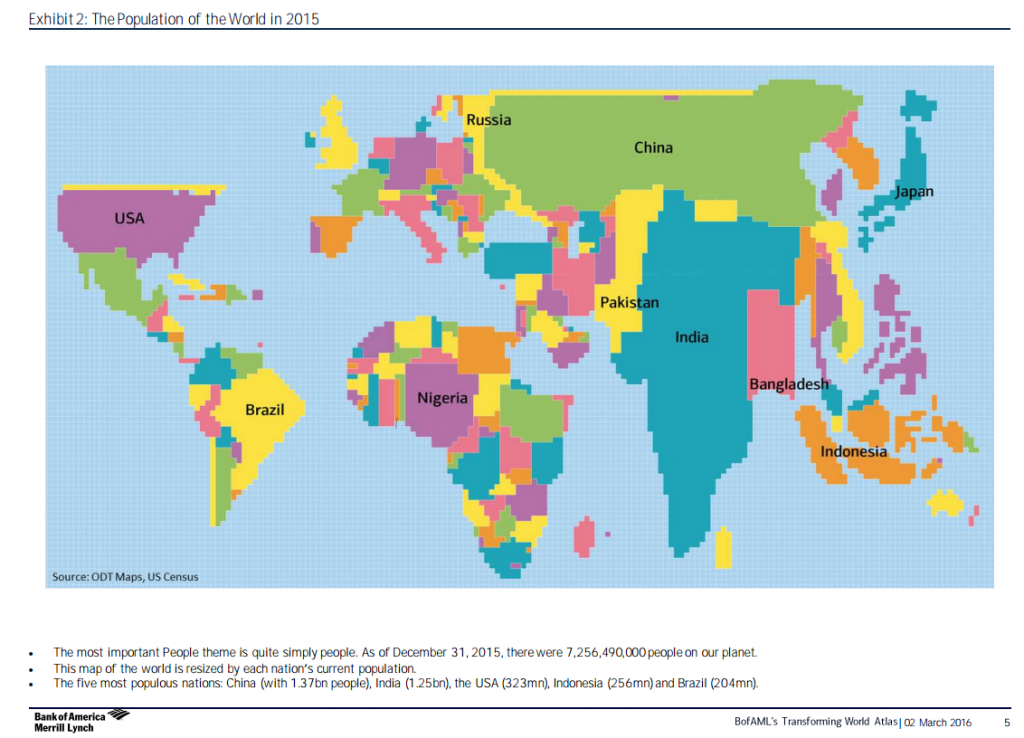

The Top 5 Most Populated Nations

- China – 1.37 billion

- India – 1.2 billion

- US – 323 million

- Indonesia – 256 million

- Brazil – 204 million

To help put this in perspective, here’s a global population map with the countries resized based on each nation’s current population. Click the map to enlarge.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

South Korean Soju No. 1, Again

Owned by Hite-Jinro, Jinro’s phenomenal success owes to several factors. It has been by far the most visible brand of soju, South Korea’s national drink, in Seoul and the surrounding districts for decades. Changes in competition laws in recent years have allowed the brand to move into other parts of the country, whose LDA population is rising sharply each year. A favourite at mealtimes, soju’s low ABV (24%) makes it suitable for a range of other occasions as well – while efforts are being made to invigorate the category’s image in the on-trade.

Officer’s Choice Whisky and Ruang Kao, No. 2 and No. 3

The markets for soju in South Korea, local whisky in India and cane spirits in Thailand are so vast that even the brands trailing far behind Jinro, Officer’s Choice and Ruang Kao sit comfortably within the global top 10. The soju brands Chum Churum (owned by Lotte, 26.2m cases) and Good Day (Muhak, 19.1m) rank fifth and ninth respectively, while the Indian whiskies McDowell’s (Diageo, 25.6m) and Imperial Blue (Pernod Ricard, 18m) are at number six and 10. Number eight on the list is Thai Beverages’ Hong Tong Liquor (20.7m cases).

The Top 10 of the Top 100

[table “” not found /]Diageo the Most Represented Brand in the Top 100

Eighteen of the brands in the Top 100 belong to Diageo, making the British company the most represented owner among brands selling over 3m cases. They are followed by Pernod Ricard with eight brands. Campari has four brands in the list, although none rank higher than 77th place (Skyy vodka).

Whisky is the No. 1 Category

Tito’s Handmade Vodka recorded stunning growth of 37.8% to leap 47 places to 46 from 93.

The list features six rums. Bacardi stays at 13, Captain Morgan drops to 24 from 21, and Havana Club remains at 68. By contrast, some categories are conspicuous by their near absence. There is only one tequila – Jose Cuervo in 47th position – among the world’s Top 100 brands, and only two bitters, Jägermeister (35) and Fernet-Branca (53). This perhaps indicates that in many parts of the world these drinks have no rival and have become the market leaders to such an extent that they define the whole category.

The 2017 edition of the IWSR’s annual Top 100 rankings has been published this month in the IWSR Magazine.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.