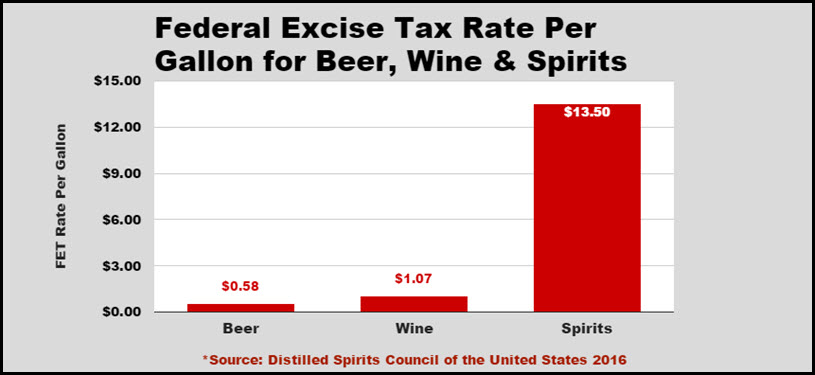

While attending the American Craft Spirits Association – ACSA show in Chicago I sat in on a session titled, “What’s New on Capitol Hill: The Fight to Reduce the FET (Federal Excise Tax).” The session was hosted by Jim Hyland, Lobbyist for the ACSA. It was pointed out that the federal excise tax rate on Distilled Spirit vs. Wine and Distilled Spirit vs. Beer were not quite fair. Drilling down on the details, there does need to be parity. Not only is it not a level playing field, it’s like the tax rates are not even in the same ball park.

Comparing Federal Excise Tax for Beer, Wine & Distilled Spirits

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

As you can see from the chart, the Distilled Spirits Federal Excise Tax rate is way, way higher than beer or wine. Compared to Wine, the Distilled Spirits rate is 1162% higher and compared to Beer, it’s 2228% higher. In 2015, the ACSA and the Distilled Spirits Council of the United States – DISCUS joined forces to deliver a single coherent message to Congress to try and get some tax relief. The results of that combined effort is now known as HR 2520. The house bill got a warm reception but didn’t make it to a full vote at this point. Here’s a summary of what’s in the bill.

HR 2520: The Distillery Innovation and Excise Tax Reform Act

- Reduce Distilled Spirits FET on the first 100k gallons of production from $13.50 to $2.70 per proof gallon. This would be a 80% reduction.

- Reduce the Distilled Spirits FET rate above 100k gallons of production from $13.50 to $9.00 per proof gallon. This would be a 33% reduction.

Distillers represent that lower rates would stimulate investment in infrastructure, product development, innovation and employment. Some experts estimate that a reduced tax rate for the nation’s small distillers could add one or two more employees to their payrolls. On December 16th, 2015 Congress decided not to include the FET reduction piece in the “tax extenders” bill. While the ASCA was disappointed that tax parity was not included, it’s much closer now than ever before.

What Can Craft Distillers Do to Help Have Their Voices Heard?

The ACSA legislative leadership committee encourages distillers to invite their local U.S. House of Representatives member and U.S. Senator to visit their distillery. Let them experience, first hand, the fruits of the distilleries labor, observe the passion, and see the dedication to growing a small business in action in their district. Congress will be holding numerous district work periods around major holidays, including President’s Day, Easter, Memorial Day and Fourth of July. These legislators routinely tour businesses in their districts, so let your desire to be seen known. Tell them your story. Make it personal. And, let ACSA legislature committee members know when your U.S. member is visiting. Committee members can provide additional guidance to make that visit a success.

Distillers can visit the ACSA Federal Excise Tax page here for more information.

Related Stories – Sign up for our newsletter to be notified of Parts 3-4.

- Part 1: The Distilled Spirits Federal Excise Tax Rate is 1162% and 2228% Higher Than Wine and Beer

- Part 2: A Look at Distilled Spirits Taxes by State [Infographic]

- Part 3: A Look at Beer Taxes by State [Infographic]

- Part 4: A Look at Wine Taxes by State [Infographic]

Please help to support Distillery Trail. Like us on Facebook and Follow us on Twitter.