Pernod Ricard continues its march onto U.S. soil in search of America’s Native Spirit with the purchase of Castle Brands. The purchase further enhances Pernod’s stable of American bourbon and whiskey brands that will now include Jefferson’s Bourbon, Rabbit Hole Distillery and Smooth Ambler Spirits.

The deal that was announced says Pernod Ricard and Castle Brands have entered into a definitive agreement under which Pernod Ricard, through a subsidiary, will acquire all of the outstanding common stock of Castle Brands for $1.27 per share in cash, or approximately $223 million.

Related Stories

Startup Rabbit Hole Distilling Sells Majority Interest of its Super-Premium Bourbon Brand to Pernod Ricard

Pernod Ricard Back in the American Whiskey Business with Majority Stake in Smooth Ambler Spirits

Under the terms of the merger agreement, which has been unanimously approved by the Castle Brands Board of Directors, Castle Brands shareholders will receive $1.27 in cash for each outstanding share of Castle Brands common stock they own, representing a 92% premium to Castle Brands’ closing share price on August 27, 2019, and a 109% premium to the 30-day volume weighted average share price through such date.

Alexandre Ricard, Chairman and Chief Executive Officer of Pernod Ricard, stated, “Through this acquisition we welcome this great brand portfolio, in particular, Jefferson’s bourbon whiskey, to the Pernod Ricard family. Bourbon is a key category in the US which is our single most important market. This deal aligns well with our consumer-centric strategy to offer our consumers the broadest line-up of high-quality premium brands. As with our American whiskies Smooth Ambler, Rabbit Hole and TX, we would provide Jefferson’s a strong route to market and secure its long-term development, while remaining true to its authentic and innovative character.”

“We are very pleased to reach an agreement with Pernod Ricard, which is the result of months of planning and deliberation by our Board of Directors,” said Richard J. Lampen, President and Chief Executive Officer of Castle Brands. “We are confident that this transaction, upon closing, will deliver immediate and substantial cash value to our shareholders.”

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

The merger agreement provides for a cash tender offer to acquire all outstanding shares of Castle Brands to be launched shortly. The closing of the tender offer will be subject to certain conditions, including the tender of shares representing at least a majority of Castle Brands’ outstanding shares, early termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act, and other customary conditions. Once the tender offer is successfully completed, Pernod Ricard will acquire all shares not acquired in the tender offer through a second-step merger in which the holders of the outstanding shares of Castle Brands common stock not tendered in the offer will receive the same per share price paid in the tender offer, in cash. The transaction is expected to close in the fourth quarter of 2019.

Bank of America Merrill Lynch acted as financial advisor to Pernod Ricard and Debevoise & Plimpton LLP acted as its legal advisor. Perella Weinberg Partners and Houlihan Lokey acted as financial advisors to Castle Brands, Holland & Knight LLP acted as Castle Brands’ legal advisor, and Sullivan & Cromwell LLP acted as legal advisor to Castle Brands’ financial advisors.

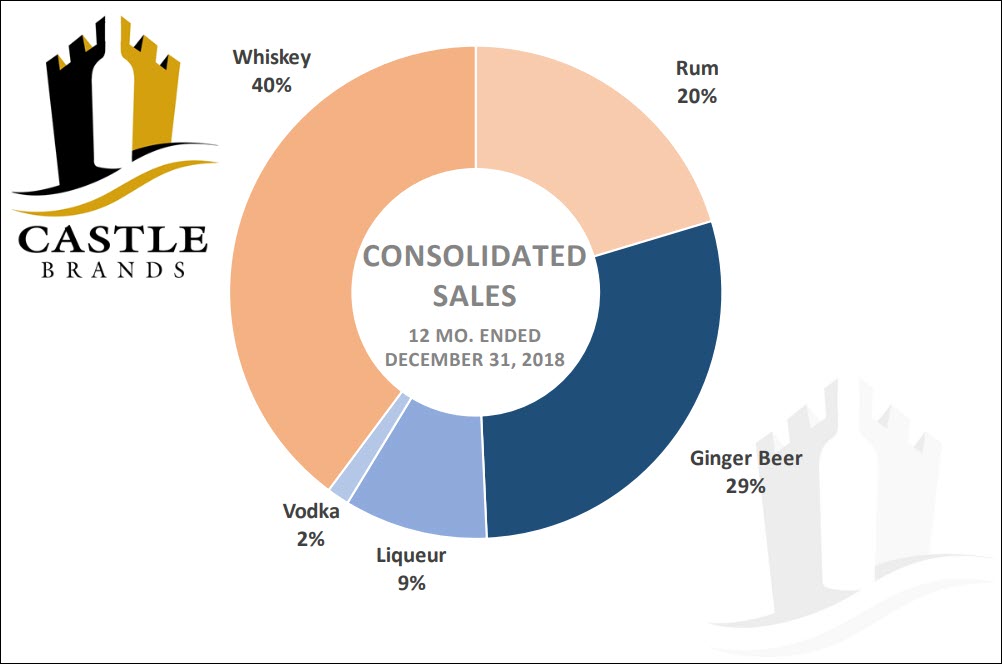

What’s in the Castle Brands Stable of Premium Spirits?

Castle Brands is include Jefferson’s®, Jefferson’s Presidential Select™, Jefferson’s Reserve®, Jefferson’s Ocean Aged at Sea Bourbon®, Jefferson’s Wine Finish Collection and Jefferson’s Wood Experiments, Goslings® Rums, Goslings® Stormy Ginger Beer, Knappogue Castle Whiskey®, Clontarf® Irish Whiskey, Pallini® Limoncello, Boru® Vodka, Brady’s® Irish Cream, The Arran Malt® Single Malt Scotch Whisky, The Robert Burns Scotch Whisky and Machrie Moor Scotch Whisky.

What’s in the Pernod Ricard Stable of Wine and Spirits?

Pernod Ricard is the No.2 worldwide producer of wines and spirits with consolidated sales of €8,987 million in FY18. Created in 1975 by the merger of Ricard and Pernod, the Group has developed through organic growth and acquisitions: Seagram (2001), Allied Domecq (2005) and Vin&Sprit (2008). Pernod Ricard, which owns 16 of the Top 100 Spirits Brands, holds one of the most prestigious and comprehensive brand portfolios in the industry, including: Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey, Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur, Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek, Brancott Estate, Campo Viejo, and Kenwood wines.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.