Engaging in “Pay-to-Play” illegal gifts, services to favored businesses, inaccurate and inadequate recordkeeping, and discriminatory sales. Does all this sound eerily familiar?

In what sounds like a modern remake of the 1987 Oscar winning film, The Untouchables, these words have actually been provided directly from the New York State Liquor Authority in a modern day “Pay-to-Play” scheme uncovered in New York state.

The offer was accepted by the Members of the SLA, Chairman Vincent Bradley and Commissioner Greeley Ford, at a meeting of the Full Board on Wednesday, December 20th, 2017. Southern has agreed to pay $3.5 million dollars in civil penalties, the largest fine ever imposed by the SLA, as well as one of the largest fines imposed by any state liquor administrator. In addition, Southern and the SLA will continue their cooperation moving forward, and the SLA will enter into an industry-leading Corporate Compliance Agreement, allowing the SLA to obtain information on systemic and systematic practice violations moving forward.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

The Multitude of Violations was Staggering

“The multitude of violations found during the course of these investigations is truly staggering,” said State Liquor Authority Chairman Vincent G. Bradley. “The SLA remains committed to rooting out abuse and corruption in the alcoholic beverage control industry to ensure a level playing field for all businesses. I am incredibly proud of the work of our enforcement and legal teams, who work hard every day to protect small businesses and consumers.”

“We will never tolerate systemic and systematic violations of the laws of our great State,” said Counsel to the Authority Christopher R. Riano. “This nationally historic settlement is a testament to New York’s strong and enduring leadership in the alcoholic beverage control industry. I look forward to working together with Southern to continue to root out deceit, deception, and exploitation of the system, and I am excited to pilot our new Corporate Compliance Agreement program moving forward.”

“Pay-to-Play” & Illegal Gifts and Services

In the Summer of 2017, and during the course of other investigations into SGWS, the SLA became aware of evidence that SGWS solicitors and managers were engaging in sales practices in direct violation of the New York State’s Alcoholic Beverage Control (ABC) Law’s prohibition on offering “Gifts & Services” to induce retail sales. Illegal gifts and services, commonly referred to as “Pay-to-Play” schemes, include providing compensation, either in cash or goods, to licensed establishments to secure the right to sell alcoholic beverages, often to the exclusion of competitors. The practice is illegal under the Consent Order and Decree of 2006, Federal Alcohol and Tobacco Tax and Trade Bureau (TTB) regulations, as well as under the ABC Law.

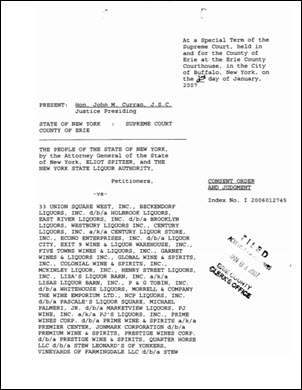

State of New York: Supreme Court, County of Erie (Signed Jan. 2, 2007)

Consent Order and Judgement, Index No. I 20060127451. ORDERED, ADJUDGED AND DECREED that this Judgment shall extend to respondents, their officers, directors, employess, agents, successors and assigns, and any other entities under respondents’ ownership or control; and it is further

INJUNCTIVE RELIEF

Soliciting or Receiving Gifts Prohibited2. ORDERED, ADJUDGED AND DECREED that each respondent is permanently barred and enjoined from, directly or indirectly, soliciting or receiving cash, cash equivalents, or gifts such as credit card swipes or AMEX checks, trips or reimbursement of travel expenses, consumer items, or any other inducement to purchase wine or liquor from wholesalers or suppliers, except as explicitly permitted by Title 9, Subtitle B of the Official Compilation COes, Rules and Regulations of the State of New York (“SLA”); (read entire decree…)

A Practice Known as “Credit Card Swipes”

Specifically, SGWS salespersons were running up large expenses on their corporate credit cards at favored retailer’s establishments, without receiving anything in return, to influence their purchasing decisions, an illegal practice commonly known as “Credit Card Swipes.” On September 26, 2017, SLA Wholesale Investigators interviewed an SGWS District Manager for the Capital Region regarding the questionable charges. When confronted with the evidence assembled by the SLA’s investigators, the District Manager admitted to running his credit card at favored establishments to artificially lower the retailers’ costs for alcohol purchases and incentivize additional purchases. SGWS’ Albany District Manager ultimately admitted to making several illegal transactions from January 1, 2017 to June 30, 2017, ranging from $50 to over $1,000 in credit card swipes. The District Manager maintained he was never questioned by SGWS management regarding his corporate account spending. In addition, SLA investigators interviewed the Director of Sales who supervised the District Manager, and he admitted to approving the fraudulent transactions as a matter of standard business procedure, with little to no actual supervision. The SLA’s investigation made clear the practice of providing “credit card swipes” to favored businesses was known, or should have been known, to SGWS sales management.

After uncovering the severity of the illegal credit card swipes, SLA Investigators requested similar expense documents from additional District Managers in the same division. On October 6, 2017, SLA Enforcement received documentation showing other SGWS sales staff and supervisors were also engaged in these fraudulent business practices. After a joint review of the documents and information available to SGWS and the SLA, SGWS admitted that a number of their solicitors and managers engaged in, or allowed others to engage in, numerous “card swipes” in direct violation of the 2006 Consent Decree and the ABC Law’s prohibition on gifts and services to retailers.

Incomplete, Inaccurate, and Inadequate Recordkeeping

Beginning in July of 2015, the SLA received retailer complaints from the owners of restaurant licenses in the Albany area. The owners had discovered that they had been placed on the SLA’s list for licensees who had failed to timely pay on their alcoholic beverage credit accounts, even though they were certain that any and all accounts were being paid in an appropriate and timely manner. The SLA was contacted and immediately began an investigation.

The SLA requested copies of additional invoices, books, and records from SGWS for their upstate sales areas dating back to January 1, 2016. A review of these books and records identified incomplete, inaccurate, and inadequate invoicing practices that failed to properly reflect a true, accurate, and complete statement of various retail transactions that were made within the upstate marketplace.

Discriminatory Sales – Certain Retailers Got Discounted Products

In order to create a level playing field, the ABC Law requires that wholesalers of wine and spirits post their prices monthly to ensure that all licensed retailers can purchase products from wholesalers at the same prices. These provisions were enacted to create market transparency, and to protect New York consumers and businesses from anti-competitive market behavior.

On December 7, 2015, the SLA received an online complaint from a small liquor store owner alleging that Southern Wine & Spirits (SGWS) had been engaging in unfair sales practices. The complainant had unsuccessfully tried on multiple occasions to order a pallet of deeply discounted wine consisting of 216 bottles that were price posted on SGWS’ internal website. The liquor store owner, who immediately placed the order after it appeared on SGWS’ website, contacted the wholesaler after his order was rejected. SGWS cooperated in the investigation and, after reviewing this information, acknowledged there were instances where the sales were not processed in the order in which they were received. The SLA found that under SGWSs’ previous ordering system, certain retailers were able to obtain discounted products, while others were routinely, and unlawfully, denied the same products in direct violation of the ABC Law.

A Chance at Redemption – A 2nd Chance at Compliance Could Save SGWS $1 Million

In addition to the $3.5 million dollar civil penalty, the SLA and SGWS have agreed to a groundbreaking new Corporate Compliance Agreement. The program will be one of the first of its kind within the alcoholic beverage control industry, creating additional obligations and responsibilities on SWGS to report suspicious activity directly to the SLA for investigation and possible prosecution. By working together to identify suspicious activity early, SGWS and SLA are creating a new scalable and replicable compliance model for the industry. The Corporate Compliance Agreement includes a Code of Business Conduct and Ethics, a Corporate Compliance Program and Policy, and provides for a Corporate Compliance Officer, as jointly appointed by the SLA and SGWS, to monitor and address suspicious activity both to SLA and SGWS.

While the civil penalty will be applied to SGWS based in Syracuse and Albany, as part of the settlement the SLA and SGWS have agreed to suspend $1.0 million dollars of the civil penalty. The suspension ensures that the new Corporate Compliance Agreement will be applicable to all of SWGSs’ licenses across the entire State of New York. In addition, the suspension is in recognition of SWGSs’ significant and substantial cooperation during the course of these investigations, and is contingent on SGWSs’ ongoing cooperation into continuing major investigations.

The New York State Liquor Authority regulates and controls the manufacture, sale and distribution of alcoholic beverages within the State. The Authority works with local law enforcement agencies and localities across the State to ensure compliance with the Alcoholic Beverage Control Law. In addition, the Authority issues and renews licenses and permits to manufacturers, distributors, wholesalers, and retailers of alcoholic beverages.

These investigations were conducted and prosecuted by the major cases team, including Beverage Control Investigator Ethan Manning, Beverage Control Investigator Brian McLean, Senior Beverage Control Investigator Martin Liepshutz, and the Authority’s leading major case prosecutor, AGC William Brennan.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.