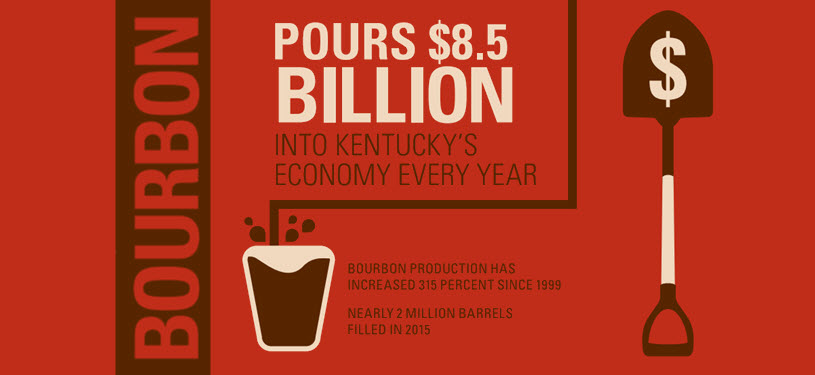

They sound nice together don’t they Bourbon and Billion. That’s what the latest report from the Urban Studies Institute at the University of Louisville prepared in conjunction with the Kentucky Distillers’ Association (KDA) shows. The report says in the last two years alone the state’s signature brown spirit increased its economic output by $1 billion and added another 2,000 distillery-related jobs to its workforce.

Add it all up and Kentucky Bourbon pours $8.5 billion each year into the state’s economy, generates as many as 17,500 good-paying jobs with an annual payroll topping $800 million and provides $825 million in tax revenue.

“This latest report proves that Kentucky Bourbon isn’t just a drink, it’s the new fuel for the state’s economy.”

~Eric Gregory – President Kentucky Distillers’ Association

The Economic and Fiscal Impacts of the Distilling Industry in Kentucky

This is the fourth statewide study of the distilling industry that the Urban Studies Institute has conducted for the Association since 2009. The current study updates and expands on the three previous studies, offering an examination of,

- The growth in the distilling industry

- The industry’s impact on the state’s agricultural sector

- Its contribution to state and local government tax revenues

- And the economic impact of Bourbon tourism.

The study is a great example of an association that represents an industry working hand-in-hand with state and local government as well as one of the state’s universities.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Distillers Know How to Draw a Crowd

Left to Right – Senate Majority Leader Damon Thayer, Kentucky Treasurer Allison Ball, Representative Adam Koenig – Chairman of the House Licensing & Occupations Committee, Dave Adkisson – President & CEO of Kentucky Chamber of Commerce, Eric Gregory – President Kentucky Distillers’ Association, Louisville Mayor Greg Fischer, Senate President Robert Stivers, House Speaker Jeff Hoover, Kentucky Governor Matt Bevin, Agriculture Commissioner Ryan Quarles.

Left to Right – Senate Majority Leader Damon Thayer, Kentucky Treasurer Allison Ball, Representative Adam Koenig – Chairman of the House Licensing & Occupations Committee, Dave Adkisson – President & CEO of Kentucky Chamber of Commerce, Eric Gregory – President Kentucky Distillers’ Association, Louisville Mayor Greg Fischer, Senate President Robert Stivers, House Speaker Jeff Hoover, Kentucky Governor Matt Bevin, Agriculture Commissioner Ryan Quarles.

Kentucky Gov. Matt Bevin unveiled the findings at a press conference at the state’s capital in Frankfort along with top state and business leaders. Noting the size of the crowd and number of media present, Bevin kicked off his remarks saying, “Talk about Bourbon and people show up.“

“The powerful growth of Kentucky’s Bourbon industry is a testament to our proud history of innovation, engineering and manufacturing. It is a genuine, home grown, only-in-Kentucky success story.”

“As we continue cutting bureaucratic red tape across the Commonwealth, we will pave the way for even more economic opportunity and job growth in the Bourbon industry, as well as every other industry across the Bluegrass state.”

Senate President Robert Stivers, agreed and applauded the industry’s economic expansion and large spin-off impact, saying, “Kentucky Bourbon is proof that our pro-business tax agenda works. By virtually eliminating the barrel tax (in 2014), we paved the way for more than one billion dollars in new distillery investments and created jobs for thousands of Kentuckians.”

Distilleries Growing Like Amber Waves of Grain

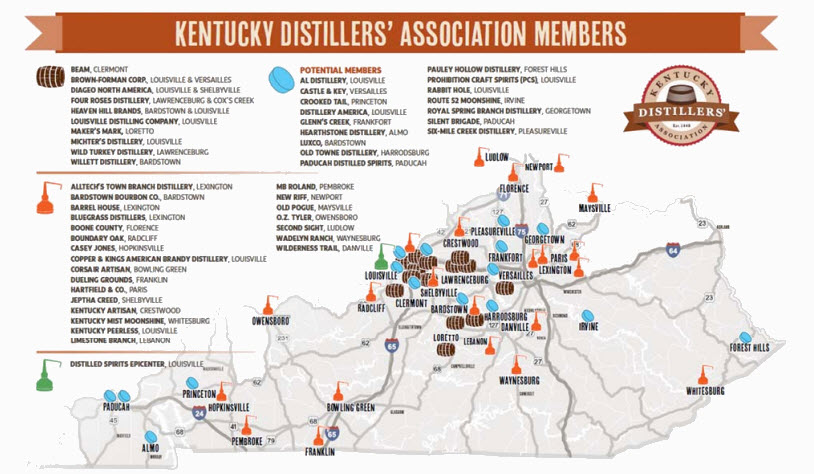

Like many states across the country, the number of distilleries operating in Kentucky has grown considerably over recent years. Since this report was first created the number of distilleries has almost tripled from 19 in 2009 to 31 in 2013 to 52 as of August 2016 with many additional applications awaiting approval. The larger distilleries are concentrated in an area the Association calls the “Amber Triangle” region of central Kentucky, an area roughly between Lexington, Louisville and Loretto. While the craft distilleries are scattered around the state.

Map Legend: Brown: Heritage Member; Orange: Craft Member; Green: Educational Member; Blue: Potential Member; September 2016.

Though the state is responsible for 95% of the world’s bourbon, Kentucky’s share of the number of establishments has slipped as other states add craft distilleries. It now ranks 11th in the nation in distillery permits according to the Department of the Treasury Alcohol and Tobacco Tax and Trade Bureau.

David Adkisson, President and CEO of the Kentucky Chamber of Commerce, said, “The outlook is bright for Bourbon – and will be brighter as we continue to improve the business environment of Kentucky.” But he noted Kentucky’s rank in the number of distilleries and overall workers has slipped nationwide. “Other states are catching up. We must continue to be proactive by cutting outdated regulations, improving our tax code and encouraging businesses to grow and create more jobs.”

6.7 Million Barrels of Bourbon Maturing in Warehouses

Newly distilled Bourbon starts out clear, the amber color comes from the time it spends interacting inside that new charred white oak barrel. All those barrels take up a lot of space in warehouses across the state.

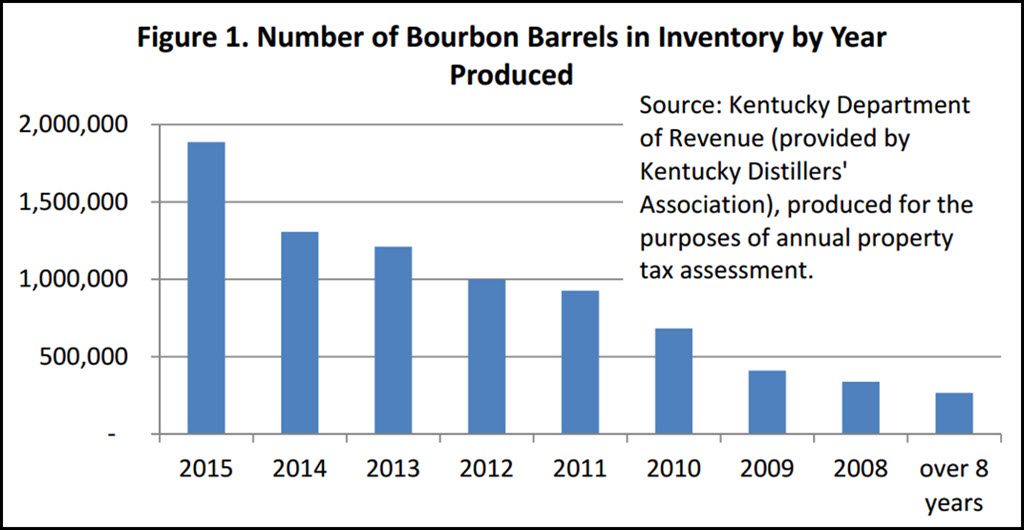

Figure 1 shows the number of bourbon barrels in inventory by year produced over the last 10+ years. (Click image to enlarge.)

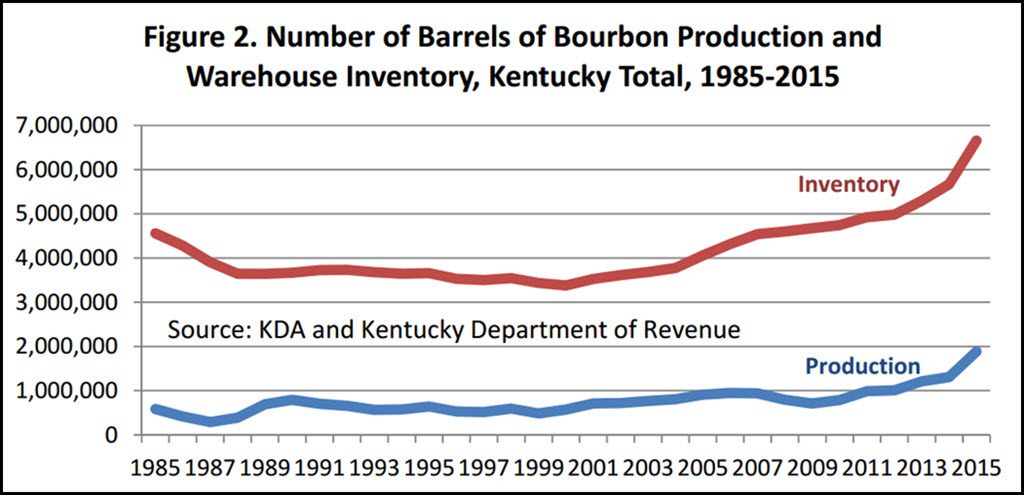

Figure 2 shows the number of barrels of bourbon production and warehouse inventory between 1985 and 2015. You can see a pattern of initially high barrel inventories, followed by declining production in the 1980s and 1990s followed by today’s bourbon boom. (Click image to enlarge.)

*This information contains barrel numbers for all Kentucky distilleries, not just KDA members.

The industry has come back strong over the last decade, with increasing demand especially for premium products, including small batch and single barrel Bourbons. Barrel inventory has now surpassed that of the 1980s and reached a level not seen since 1974. The 6.7 million barrels of Bourbon in warehouses in 2015 does not reflect the approximately 320,000 barrels that were reused to make non‐Bourbon products, or the 210,000 barrels of neutral spirits produced.

Impact of Bourbon on States Agricultural Production

The Kentucky capital sits beside the Limestone rich waters of the Kentucky River.

The survey for the 2014 report revealed that KDA members used approximately 11 million bushels of corn in their production process, about 50% of which came from Kentucky farmers. Their use of other grains like wheat and rye, from Kentucky farmers was considerably lower, about 25 million bushels or around 18% of grains used. The 2016 survey showed a 65% increase in locally grown corn use since 2014. Given the substantial increase in production volume in 2015, which amounted to between 15 and 20 million bushels. Three KDA members reported using 100% locally grown corn.

Agriculture Commissioner Ryan Quarles said he was particularly pleased with the increased usage of Kentucky corn. “We have been working with the KDA and our distilleries to source more local corn, so it’s good to see that our efforts are paying off. We’re thrilled that as bourbon’s global presence grows, so do opportunities for Kentucky’s farmers.”

Just How Much Grain Goes Into a Barrel of Bourbon?

Because mash bills vary by distiller and they each use proprietary processes (and the individual knowledge of their Master Distiller) there is no set amount of grain that goes into a barrel of Bourbon (other than it must be at least 51% corn). Most sources we have seen on the subject give figures that work out to between eight and nine bushels of corn per barrel of Bourbon and two to three bushels of other grains like Rye, Wheat or Malted Barley. For the most part, each barrel of bourbon is made up of approximately 12 bushels of grain per barrel. Including the other products distilled by Kentucky distillers, they currently utilize 12 to 12.5 million bushels of corn and 4 million bushels of other grains (primarily wheat, malted barley, and rye) each year.

Corn and wheat grow relatively well in Kentucky’s soil and climate and there are many thousands of acres of each planted every year. But there is very little rye or barley production in Kentucky primarily due to the fact neither can be efficiently produced in the state’s soil and climate conditions compared to dryer, more northern climates. Given this, local sourcing of grain inputs for Kentucky distillers refers almost exclusively to corn and wheat.

There are only two things in life that are constant – Death and Taxes

Though it’s great to be number one in most categories when it comes to taxes that’s one list where you would prefer to be on the bottom.

In this world nothing can be said to be certain, except death and taxes.

~ Benjamin Franklin

Kentucky’s spirits tax rate is fifth highest in the country among open market states. The distilling industry pays 34.4 cents in taxes per dollar of output ‐‐ the highest of all 536 manufacturing industries in the state. Breweries pay about 16 cents per dollar of output and wineries are taxed at 3.5 cents per dollar of output. The next highest tax category is amusement parks at 20.5 cents per dollar of output. Kentucky distillers paid around $625 million in federal excise taxes during 2015. Distilling production and consumption was responsible for $190 million in Kentucky state and local government revenues last year.

Kentucky Governor Matt Bevin made a pledge at the meeting. “The bottom line is this, we tax it (bourbon) already like we tax nothing else in the state. I will say to you all, we have tax reform coming. It’s going to look like a lot of different things and it will be something we’ll be wrestling… with in the months ahead, but one thing I’m pretty confident in saying is that, and I’ll say this publicly, I think we are squeezing quite enough blood from this stone, so I can take comfort in that I think we should celebrate the chance to expand this industry, not suffocate it.”

Related Stories

How High Are Distilled Spirits Excise Taxes in Your State [Infographic]

The Distilled Spirits Federal Excise Tax Rate is 1162% and 2228% Higher Than Wine and Beer

Bourbon: The New Economic Fuel for Kentucky Full Presentation [Full Video] – Watch the meeting at the state capital from start to finish.

Bourbon Tourism Booms to More Than 1 Million Visits in 2016

House Speaker Jeff Hoover said the study just scratches the surface of Bourbon’s growing impact. Many distilleries are still working to implement tourism reforms under Senate Bill 11, which passed the House by historic margins. The bill which went into effect in July 2016 allows distillery visitors to sample up to 1.75 ounces of spirits, increased the number of bottles that could be purchased at a distillery from three to six 750 ml bottles and for the first time allows for sales of mixed drinks. (Yes. I know, it’s hard to believe but not everyone likes to drink it neat.)

“There were more than one million visits to the Kentucky Bourbon Trail and Kentucky Bourbon Trail Craft Tour experiences last year, elevating the Kentucky tourism experience to levels never seen before,” he said.

Related Stories

Kentucky Bourbon Trail Cup Runneth Over Exceeding 1 Million Tourist Visits in 2016

Buffalo Trace Distillery Celebrates 17% Increase in Tourism

Distilleries in the Middle of a $1.2 Billion Building Boom

Nearly all the distilleries are expanding capacity, erecting new warehouses for barrel aging and putting more of a focus on creating a unique Napa Valley like visitor experience.

In 2014, a survey of KDA members reported that their executed capital projects over the five year period 2008‐2013 were just over $400 million. Their anticipated capital projects for the period 2014‐2019 were $630 million. We asked the same question in the survey for this report and found that executed capital projects for 2010‐2015 was $485 million and planned projects 2016‐2021 was about $620 million. These projects likely include both real and tangible properties.

Estimated Industry Growth Projection Through 2020

The Urban Studies Institute put together a projection through 2020 based on earlier 2008, 2011, 2013 and 2015 findings. They noted that, “As with all projections based on historical data, the reader should be aware that there is an implicit assumption that the industry will behave in future periods just as it did in previous periods. More specifically, the distilling industry has experienced remarkable growth over the past seven years which may not be realized, or realized in the same magnitude, in future years.”

This table presents the projections for 2020, all caveats pertaining. Employment should top 20,000, payroll $1 billion and output $10 billion.

Projected Annual Economic Impact of Distilling Industry in Kentucky by 2020

| Report Year | Employment | Output | Payroll |

|---|---|---|---|

| 2008 | 9,848 | $5.4 billion | $441 million |

| 2011 | 10,311 | $5.6 billion | $447 million |

| 2013 | 15,416 | $76 billion | $707 million |

| 2015 | 15,229 | $8.5 billion | $797 million |

| 2020 | 20,134 | $10.7 billion | $1 billion |

Source: Customized IMLAN (Impacts for PLANning), Version 3.1 Note: Total effects include direct, indirect (business‐to‐business spin‐off spending, and induced (household spending resulting from increased earnings).

Using the same methodology, Urban Studies Institute projects the future stream of state and local taxes from the distilling industry based on tax receipts observed in the prior report periods. State tax receipts should approach $200 million by 2020 and local tax receipts should approach $42 million. Again, these projections assume that there is no change in tax rate or structure either at the state or local levels. While that may be a reasonable assumption at the state level, local tax rates and bases tend to vary more over time.

Now it’s time to sit back and raise a glass.

Abraham Lincoln welcomes all visitors as they enter the Kentucky State Capital building.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.

Resource: Urban Studies Institute, The Economic and Fiscal Impacts of the Distilling Industry in Kentucky – January 2017